How to Calculate Sales Tax? Difference Between Inclusive and Exclusive Tax

Businesses calculate sales tax for various reasons and they use different methods to do this. One simple and effective method is using a sales tax calculator. It includes both inclusive and exclusive tax methods to determine the final price of a product or service.

Inclusive tax is a method that means the sales tax amount is already included in the product or service price. Simply, the displayed price amount already includes tax and the base price. On the other hand, exclusive tax shows only the base price of a product or service. The sales tax is then calculated separately based on this base price, using the applicable rate, to arrive at the final price.

Key Takeaways

- Understand What is Sales Tax and Its Importance

- Identify the Difference between Inclusive and Exclusive Tax

- A Step-by-Step Guide to Using a Sales Tax Calculator to do the math and Set Sales Price

- Understand the Best Tips and Practices Related to Sales Tax Calculation

Importance of Understanding Sales Tax

Generally, People pay taxes when they purchase a product or service. The government imposes a sales tax on businesses, which is included in the sales price. The tax money is then transferred to the government for many development and public service requirements.

So, why is it important to understand the sales tax? The answer is apparent. Understanding this regulation helps businesses lead their operations without legal issues or penalties. Also, the general public can understand the importance of paying tax money for a country’s economic development.

Moreover, this ensures that businesses adhere to government tax policies when selling products or services. Further, it brings huge benefits to the businesses and the economy of the country. In addition to these reasons, it creates many opportunities indirectly.

For example, the government takes this money to develop infrastructures and community services which creates job opportunities, and indirect benefits to the people.

Understanding the Difference Between Inclusive and Exclusive Tax

A. Inclusive Tax

Inclusive tax includes the total tax amount in the product or service's displayed price. This approach is particularly helpful for determining the sales tax amount and calculating the base price or net sales value before tax. Here's an example to understand clearly:

A business has sold 50 products with a $4000 sales value and the tax rate is 15% inclusive. It can easily calculate the tax amount as $521.74. By subtracting this tax from the gross sales value, the net sales value before tax is $4,000 – $521.74 = $3,478.26.

B. Exclusive Tax

Exclusive tax displays the sales price without tax addition. This means that the price is yet to be set with sales tax. For example, a company has sold 50 products with a $4000 sales value and the tax rate is 15%.

Here the sales tax is calculated in the base price which is $4000. So, the tax rate is $600 and the total/final sales price is $4600.

The Differences Between Inclusive and Exclusive Tax and Pricing

Let’s understand the difference between inclusive and exclusive tax in the table below:

| Inclusive Tax | Exclusive Tax |

|---|---|

| Total sales price includes sales tax | Only displays the base price, tax added separately |

| Simplifies the pricing, Customers easily find the total value with sales tax included. | Provides transparency which describes the sales tax with the price to show the total sales price. |

| Example: Sales price is $100 with an inclusive tax rate of 15%. So, the sales value without tax is $86.96 and the tax is $13.04 | Example: Sales price exclusive of sales tax is $100 and the tax rate is 15%. So, the tax amount is $15 and the final sales price is $115 |

The table above clearly highlights the key differences between inclusive and exclusive taxes, as well as their calculation methods. Understanding these differences is crucial for business owners to accurately determine the final sales price and the applicable tax obligations.

For the general public or consumers, knowing this difference is essential to understand how much they are paying in taxes for the products or services they purchase.

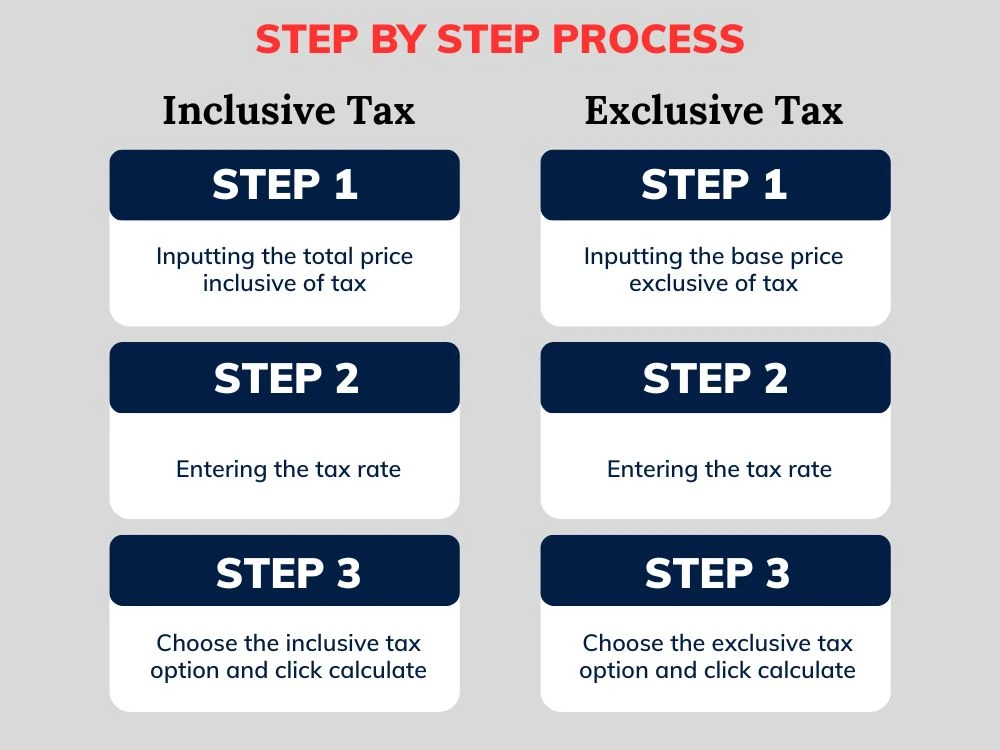

Step-by-Step Guide to Calculating Sales Tax with Inclusive and Exclusive Tax Examples

Using the Sales Tax Calculator for Inclusive Pricing

By using the sales tax calculator at Smart Tools AI, you can easily calculate the tax value included in the sales price. Follow this step-by-step process:

- Inputting the total price inclusive of tax: First thing is, you have to input the total price of a product or service with inclusive tax. For example, $850

- Entering the tax rate: Second, you have to enter the sales tax rate. For example, 18%

- Choose the inclusive tax option and click calculate: By doing this last step you can easily figure out the sales tax amount and base (Net) price. According to the example, 18% in $850 = $129.66 as sales tax and $720.34 as the base price.

Using the Sales Tax Calculator for Exclusive Pricing

In this process, you must enter the base price and sales tax rate. Follow the below steps and example to find a clear view:

- Inputting the base price exclusive of tax: First, input the base price of a product or service without tax added or exclusive tax. For example, $850

- Entering the tax rate: Second, enter the tax rate. For example, 18%

- Choose the exclusive tax option and click calculate: By doing this, you will be able to find out the exclusive sales tax amount which will be added to determine the final sales price. According to the example, 18% in $850 = $153 as sales tax, and the final price or gross value is $850+$153= $1003

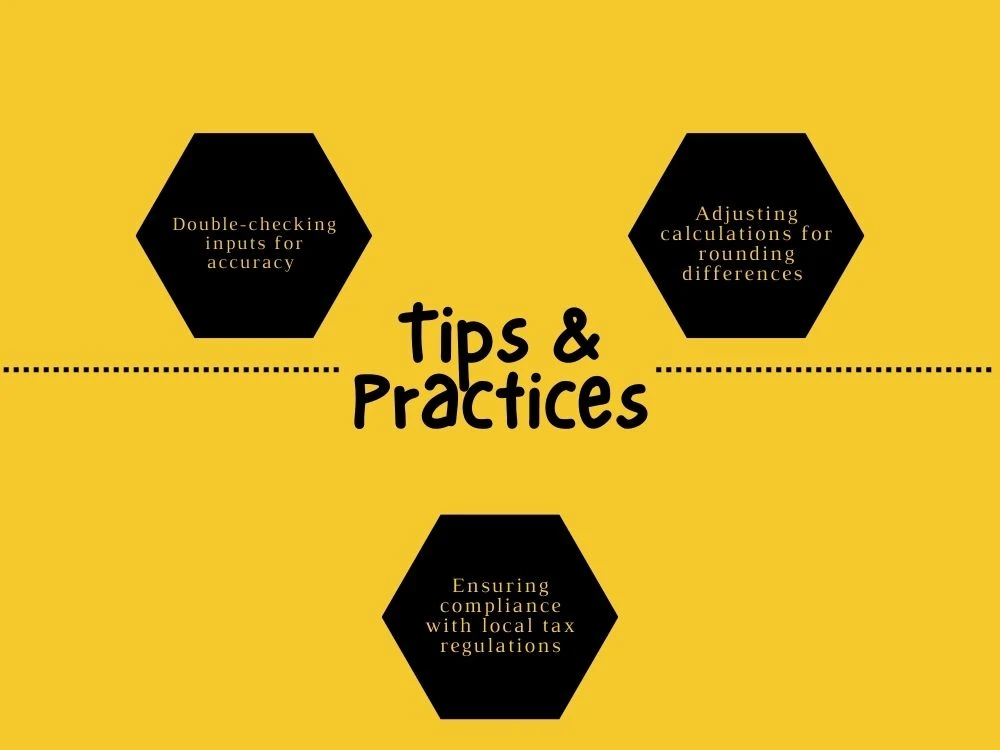

Tips and Best Practices

The following tips and practices are useful when it comes to sales tax calculation. Let’s find them one by one and try to incorporate them into practice.

A. Double-checking Inputs for Accuracy

It is always better to double-check the input values for accurate sales tax calculation results. Businesses should bear in mind that they are dealing with sales tax value which is eventually imposed on consumers (the general public). Therefore, errors in calculations may go wrong in different ways like losing customer trust, government penalties, reputational loss, etc.

Also, firms should understand the necessity of paying the right sales tax amount to the government. So, they should always double-check the entries whether the base, gross price of the product, or updated sales tax rate are accurate.

B. Adjusting Calculations for Rounding Differences

Sales tax is calculated for both round figures and decimal values of product price. When businesses calculate the sales tax value, they should choose to round the final value to the nearest round figure.

This approach helps minimize discrepancies and helps understand the final sales price value easily where firms can avoid calculation errors. Plus, this ensures specific rules outlined by tax authorities regarding rounding rules.

C. Ensuring Compliance with Local Tax Regulations

Ensuring compliance is a very important practice where organizations should always comply with local tax regulations. Failing to do so can lead to many legal issues. When calculating the sales tax amount, companies have to do that accurately.

It is the business’s responsibility to calculate and collect the right sales tax amount, maintain proper records for audits, and file tax returns within the timeframes.

Final Thoughts

Sales tax is the amount of tax added to products and services prices. It can be calculated in two different formats identified as inclusive tax and exclusive tax. Governments generally impose this tax on businesses, and companies charge them from their customers.

The sales tax collected by the government is generally used for development purposes. Therefore, businesses and the general public should perceive the importance of it. A sales tax calculator helps effectively calculate sales tax using both inclusive and exclusive options.

Inclusive tax simply means the tax added to the gross product value. Conversely, exclusive tax is separately added to the base price of the product or service. Several tips are followed to improve the efficiency in sales tax calculation such as double-checking the input values, adjusting calculations for rounding differences, and ensuring compliance with local tax regulations.

FAQs

Q1: How sales tax is calculated?

Sales tax is calculated for the product price. If it is the gross price value then the inclusive tax method is used which already has the tax included in the price. If it is the base price value of a product then an exclusive tax method is used which adds the tax amount to the base price to fix the final gross value.

Q2: What is the sales tax rate in the USA?

The sales tax percentage varies relevant on different states in the US. Mostly it falls between 0 to 10 %. The type of goods and services also influence the rate.

Q3: Why is sales tax important?

The government uses the sales tax collected for many development purposes. It includes public services like healthcare, education, and infrastructure developments.

Q4: What are some tips in sales tax calculation?

Maintaining accuracy in sales tax calculation is an important tip to avoid calculation errors. Also, ensuring compliance with local tax regulations and adjusting to a round figure are some crucial tips and strategies.

Explore Related Posts

https://smarttoolsai.com/post/what-is-phantom-tax

https://smarttoolsai.com/post/offshore-merchant-processing-for-high-risk-businesses

https://smarttoolsai.com/post/multi-step-income-statement-a-practical-guide-for-financial-clarity

.webp)