A Quick Guide to Offshore Merchant Processing for High-Risk Businesses

As a high-risk business owner, you may know that acquiring your ideal payment solution means overcoming many hurdles. Local banks and payment processors have strict regulations and exorbitant fees, which makes it difficult for such businesses to run operations and transactions.

This is where offshore merchant processing is inevitable. For high-risk businesses, an offshore merchant account presents limitless options for conducting their transactions all over the world without any restrictions or issues.

In this guide, we will be discussing widely about offshore merchant processing, its advantages to high-risk businesses, and how to navigate the process effectively.

Key Takeaways

- Learn about offshore merchant processing and how it enables high-risk businesses to have global operations without restrictions imposed by local payment processors.

- Identify the crucial benefits of an offshore merchant account that include minimal documentation, lower costs of operation, more privacy, and currency flexibility.

- Explore several important things to consider when selecting your offshore merchant account including selecting tax implications, risk management, legal framework, and currency and payment processing.

- Understand how to set up your offshore merchant account from selecting a provider to paperwork management and other tips on avoiding pitfalls.

Why High-Risk Businesses Turn to Offshore Merchant Processing

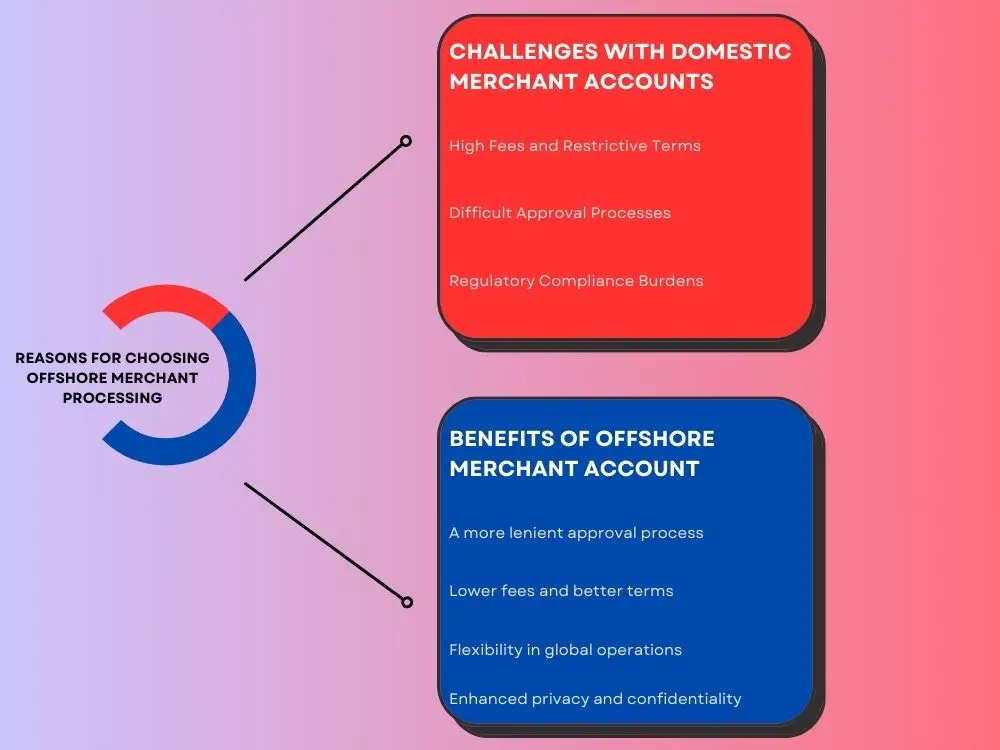

Challenges with Domestic Merchant Accounts

High-risk companies such as those working in sectors like online gaming, CBD, travel, and many others often encounter considerable obstacles when trying to obtain a domestic merchant account.

Banks and conventional payment processors frequently label these firms as high-risk because of the increased frequency of chargeback events, high volume transactions, and the character of goods or services marketed.

These issues particularly lead to the following problems and that’s why these businesses think about offshore merchant accounts:

- High Fees and Restrictive Terms: Generally used by domestic payment processors to reduce the risks that are posed by high-risk businesses.

- Difficult Approval Processes: Many high-risk ventures find it difficult to have their merchant accounts approved within their own countries. The rigorous application processes plus the high chances of being rejected could delay some business operations.

- Regulatory Compliance Burdens: When it comes to local laws, maintaining a domestic high-risk merchant account can be an obstacle, especially for industries with a lot of regulation involved.

Benefits of Offshore Merchant Account

Businesses get many benefits through an offshore merchant account. This is generally because of the increasing number of challenges they face in domestic merchant accounts. Here are some benefits of why high-risk companies prefer this:

- More lenient approval process: Most offshore processors have more lenient approval criteria. This makes it easier for high-risk companies to obtain a merchant account. This could be an ending point for those who have failed at getting one from domestic payment processors.

- Lower fees and better terms: Offshore processors tend to offer competitive rates such as lower transaction charges and flexible policies. This can work out really well with low-margin businesses.

- Flexibility in global operations: With an offshore merchant account you are free to operate internationally without facing any local constraints whatsoever. Plus, it helps reach larger markets while unlocking new revenue channels.

- Enhanced privacy and confidentiality: Most offshore jurisdictions provide greater privacy features which means that businesses can be operated under complete confidentiality levels.

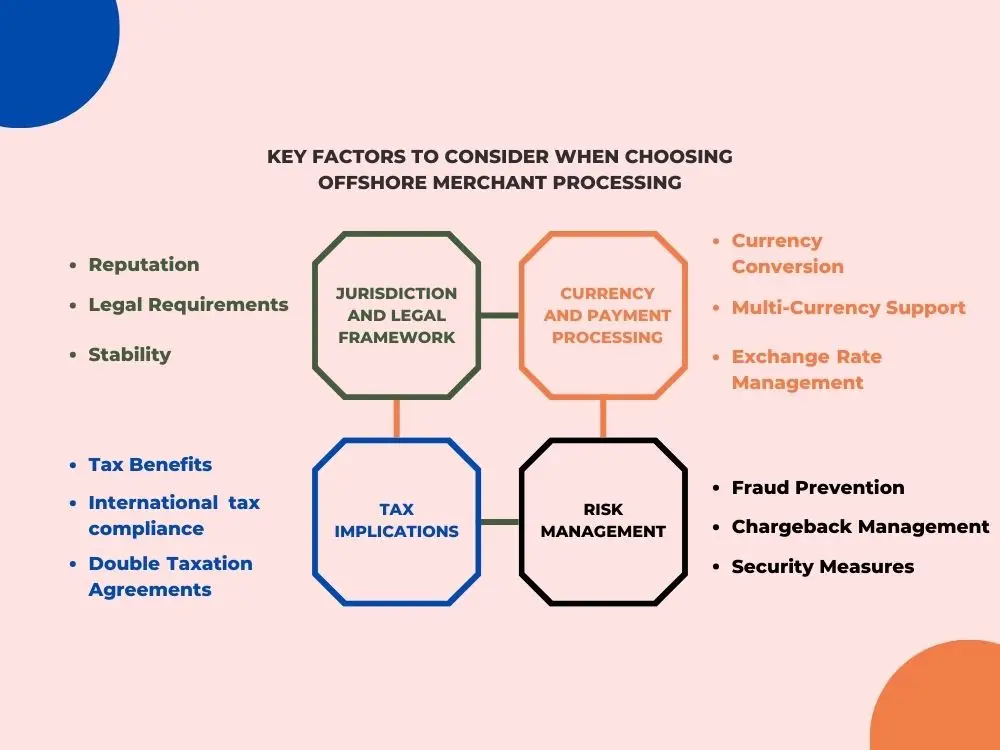

Key Considerations When Choosing Offshore Merchant Processing

It’s essential to consider some factors before entering into offshore merchant processing so that you can verify it's ideal for your company.

A) Jurisdiction and Legal Framework

The jurisdiction of your offshore merchant account significantly influences your business. Each jurisdiction has its own legal framework, regulatory environment, and level of scrutiny. Therefore, you should consider the following factors when choosing a jurisdiction:

- Reputation: You should go for jurisdictions with a good reputation in terms of financial stability as well as compliance. This may help enhance the credibility of your organization and ease the transaction process you make.

- Legal Requirements: Find out what laws and rules apply in that area regarding money transactions including anti-money laundering (AML) acts, tax duties, and any other reporting requirements.

- Stability: Selecting a jurisdiction that is associated with political and economic stability is the best option. Otherwise, there may be sudden changes in regulations which can adversely affect your business.

B) Currency and Payment Processing

Managing multiple currencies is important for high-risk firms that use an overseas merchant account. Offshore merchant processors usually support a variety of currencies which makes it easy for firms to operate globally. But the following factors are important to be considered:

- Currency Conversion: You should be aware of the fees related to the currency conversion which can weigh down on your net income. Some processors may have more favorable rates than others.

- Multi-Currency Support: Verify that the offshore merchant processor you choose can effectively deal with transactions in those currencies that matter most to your business and customer base.

- Exchange Rate Management: Always be watchful over the exchange rates and consider proper ways to manage the potential risks associated with currency fluctuations.

C) Tax Implications

If you go for an offshore merchant account, it has one of the potential advantages known as favorable tax environments offered by some jurisdictions. However, it is very important to understand tax implications comprehensively. It includes the following things:

- Tax Benefits: Some offshore jurisdictions have low corporate tax rates. This will lead to an enormous reduction in the tax burden on your high-risk business. Although this rate differs greatly from one jurisdiction to another.

- International tax compliance: It's important to comply with both the offshore tax laws jurisdiction and any international tax obligations relevant to your home country.

- Double Taxation Agreements: One of the significant things that you should do is to search for jurisdictions that have double taxation agreements with your home country. It assists people who might otherwise pay taxes twice on similar sources of income.

D) Risk Management

Risk management is a core aspect of keeping successful offshore merchant accounts. Particularly, high-risk businesses are prone to issues such as fraud and chargebacks, so it's essential to have strong strategies. This includes things like:

- Fraud Prevention: Offshore processors provide advanced fraud detection tools that help to protect your enterprise from fraudulent transactions. You should make sure that your merchant processor has a good track record on this matter.

- Chargeback Management: Chargebacks can be a costly issue for high-risk firms. Therefore, look for any support or tools in chargeback management and reduction from offshore merchant processors.

- Security Measures: Ensure that the offshore processor maintains up-to-date security protocols such as PCI DSS compliance standards to prevent hacking and safeguard confidential customer data.

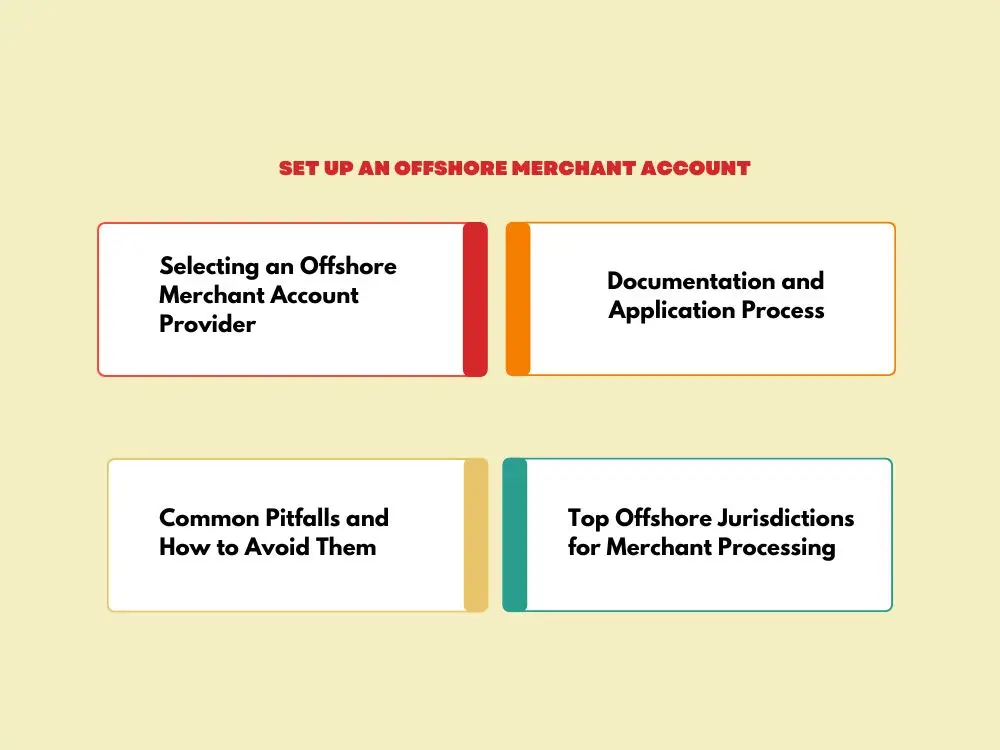

Steps to Set Up an Offshore Merchant Account

You have to follow certain steps to set up an offshore merchant account. It involves the following things which can help you get started:

1) Selecting an Offshore Merchant Account Provider

It's vital to choose the correct provider which entails so many things as follows:

- Reputation and Experience: Look out for merchant providers with good reputations and experiences when dealing with high-risk accounts. Also, check them through reviews, testimonials and case studies then judge their reliability based on what you find.

- Range of Services: Ensure the offshore merchant account provider offers all the services you require like multi-currency support systems, fraud prevention tools, or any other related needs.

- Customer Support: This is important especially if there are problems with your account. Therefore, you should go for a good merchant account provider. A company that provides responsive customer service from knowledgeable staff members should be chosen to avoid negative effects on business activities as a result of administrative delays in payment processing.

2) Documentation and Application Process

After selecting your provider, the next step is to prepare your application. This typically involves:

- Compiling all required documents: You have to gather all necessary documents including identity proof, proof of business registration, bank statements, and a business plan.

- Completing your application form: This can be done by filling in all necessary information in the form provided by your preferred merchant provider. Plus, you should complete the form with precise details so that it doesn't take longer for approval.

- Applying: Once you are done with filling out the forms, send them off and wait for a reply which may either take some days or weeks depending on where you live, and the type of delivery company you picked and jurisdiction.

3) Common Pitfalls and How to Avoid Them

There are certain issues faced by businesses when setting up an offshore merchant account. So, following some vital aspects may help avoid them. Here are some common pitfalls and avoiding methods:

- Incomplete Documentation: If there is no full documentation provided, it can take more time to get things done. This means you need to check if everything required is intact before sending in any paperwork.

- Making the Wrong Choice of Jurisdiction: Different countries have different regulations regarding businesses. Thus, conducting research would help individuals get jurisdictions that relate to their business needs as well as their goals.

- Ignoring Regulatory Compliance: If your high-risk business ignores the mandatory regulations set forth by an offshore jurisdiction, it may face severe fines or penalties, sometimes leading to the closure of the merchant account itself. For this reason, one should be aware of the legal commitments mandated by the chosen offshore merchant jurisdiction.

Top Offshore Jurisdictions for Merchant Processing

When you choose an offshore merchant account, some jurisdictions are recognized particularly for the conducive environments they provide:

- Malta: This country is known for its robust regulatory environment and support for fintech companies. Malta is a widely preferred offshore merchant processing destination. It has strong privacy protections and is connected to the EU which could assist in reaching European clients.

- Cayman Islands: With no corporate taxes and an excellent banking system, the Cayman Islands are famous all over the world. High-risk firms looking to save on taxes or protect their information can prefer this jurisdiction.

- Singapore: Singapore is famous for its financial stability and innovation. Plus, it has favorable and explicit taxes. Therefore, it is often recommended when starting up a business in Asia.

How to Manage Your Offshore Merchant Account

Once you set up your offshore merchant account, the next step is to effectively manage it. Moreover, it is the key to smooth operations and financial success.

Monitoring and Managing Transactions

For you to maintain control over your account, regular monitoring and managing of transactions is important:

- Utilize monitoring tools: You can use tools offered by your offshore merchant processor to track transactions in real time, manage cash flow, and identify any anomalies.

- Stay compliant: Make sure that all the transactions comply with necessary legal and regulatory requirements about your offshore jurisdiction and other relevant authorities.

- Manage currency exchange rates: Monitor exchange rates carefully and make informed decisions pertaining to minimizing currency conversion costs.

Ongoing Maintenance and Support

To ensure the long-term success of your offshore merchant account, it is essential to have continuous support and maintenance. Here are some vital things to follow:

- Regular Account Reviews: You should review your account periodically to ensure it meets your business needs. This includes looking into the agreement terms and charges, as well as checking how well fraud prevention tools are working.

- Collaborate with Your Provider: Another important thing is keeping open communication with your offshore merchant account provider at all times. Further, you must solve any issues instantly and seek their advice on enhancing your account.

- Plan for Growth: As your business expands, your account should scale accordingly. Therefore, you should work with your provider to accommodate your account for more transactions or any new operational requirements that arise.

Final Words

High-risk businesses face some challenges with domestic payment processors such as difficulties in getting approval, high chargeback rates, etc. These challenges lead businesses to choose offshore merchant account which has some potential benefits over choosing a domestic one.

By obtaining this account, firms can expand their global reach and improve their financial flexibility. To ensure this, firms should carefully select the appropriate offshore jurisdiction, understand the legal and tax implications, and apply efficient risk management plans.

Further, when creating an offshore merchant account, businesses have to follow certain setup procedures. This will guarantee a smooth and successful process. Plus, managing the account involves proper monitoring, transaction management, ongoing maintenance, and adequate support.

FAQs

Q1: How long does it take to set up an offshore merchant account?

The setup duration varies from one provider to another and jurisdiction-wise. But it usually takes a few days to weeks.

Q2: How does using offshore merchant processing help high-risk businesses?

Offshore merchant processing helps high-risk businesses to be less restrictive with approval criteria and pay lower transaction fees. This convenience gives them more flexibility when doing business globally, making it easy to manage their financial transactions without any local hindrances.

Q3: What are the risks involved in offshore merchant processing?

The risks include possible legal or tax issues, currency exchange fluctuations, and the requirement for strong measures against fraud and chargeback management practices.

Q4: Is it legal to use offshore merchant processing?

Yes, offshore merchant processing is legal. However, all high-risk businesses should comply with all necessary regulations from both offshore jurisdictions and their own respective nation's laws.

Explore Related Articles

https://smarttoolsai.com/post/high-risk-merchant-account-at-highriskpay-com

.webp)