Return Item Chargeback: What Every Merchant Should Know

Have you ever thought that a return item chargeback might be a headache for your business that significantly drains your profits? This issue can impact industries with high risks. That’s why businesses need to fully understand how chargebacks work, their financial impact, and methods to prevent them.

By gaining this understanding, you can better navigate the complex world of chargebacks and ensure a healthy business. This guide will serve as the navigational map that helps you become well-versed in the dynamics of return item chargeback and how to minimize their effects on your revenue.

Additionally, you will discover practical tips for effectively managing chargebacks. So, take a look at the next section to see what this article covers.

Key Takeaways

- Understand What a Return Item Chargeback Is: Get to know the meaning of return item chargeback as well as its impacts, and how it can affect your finances if you are running a business.

- Differentiate Chargebacks from Refunds: Identify the primary differences between chargebacks and refunds. Plus, understand why refunds can be less costly for your business.

- Learn Strategies for Chargeback Prevention: Find out the best practices and vital tools to minimize return item chargeback which includes clear return policies and chargeback prevention technologies.

- Evaluate Chargeback Insurance: A discussion on both the advantages and expenses involved in obtaining chargeback insurance for safeguarding high-risk merchants.

- Regulatory Compliance: Understand the legal and regulatory considerations of chargebacks to better protect your business during disputes.

Understanding Return Item Chargeback

What Does Return Item Chargeback Mean?

When a customer has returned a product and disputes for their money back through a chargeback with the bank, then it is known as a return item chargeback. This often happens when the customer finds fault in what they bought or feels that it was not as it was described.

Also, in cases where they say that they never made that purchase at all. For merchants, this can be a complex and costly issue that may lead to revenue loss and potential penalties.

Types of Return Item Chargeback

A return item chargeback may vary based on several reasons behind them. Some common types include chargebacks for defective products, items that are not as described, or unauthorized purchases. Each type has its own challenges.

Plus, understanding them can help merchants better prepare for disputes. Unlike other chargebacks, return item chargebacks specifically involve a returned product that adds another layer of complexity to the resolution process.

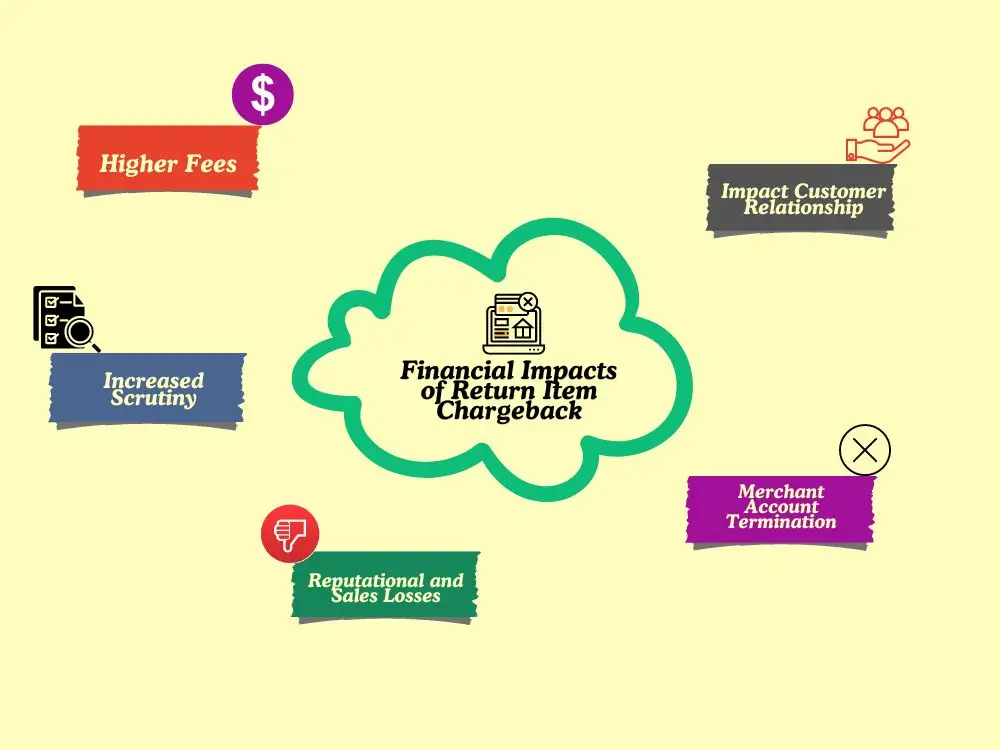

The Financial Impact of Return Item Chargeback

How Return Item Chargeback Affects Your Bottom Line

Most businesses face a serious financial hit after a return item chargeback is processed. There are various other costs as well, which include the costs incurred from the processing of payment since you will be charged more than what you sold.

However, if chargebacks are not managed effectively, these costs can easily add up. Besides, frequent chargebacks may drive up processing rates, incur stricter terms, or even result in the loss of the merchant account.

Long-Term Consequences of Ignoring Chargeback Issues

If you ignore to effectively manage chargebacks and issues related to them, they could have long-term consequences for your business. Frequent and repeated chargebacks can significantly damage your relationship with your payment processor.

Moreover, this may lead to increased scrutiny, higher fees, or account termination. In extreme cases, your business may be placed on a match list which makes it difficult to secure a high risk merchant account in the future.

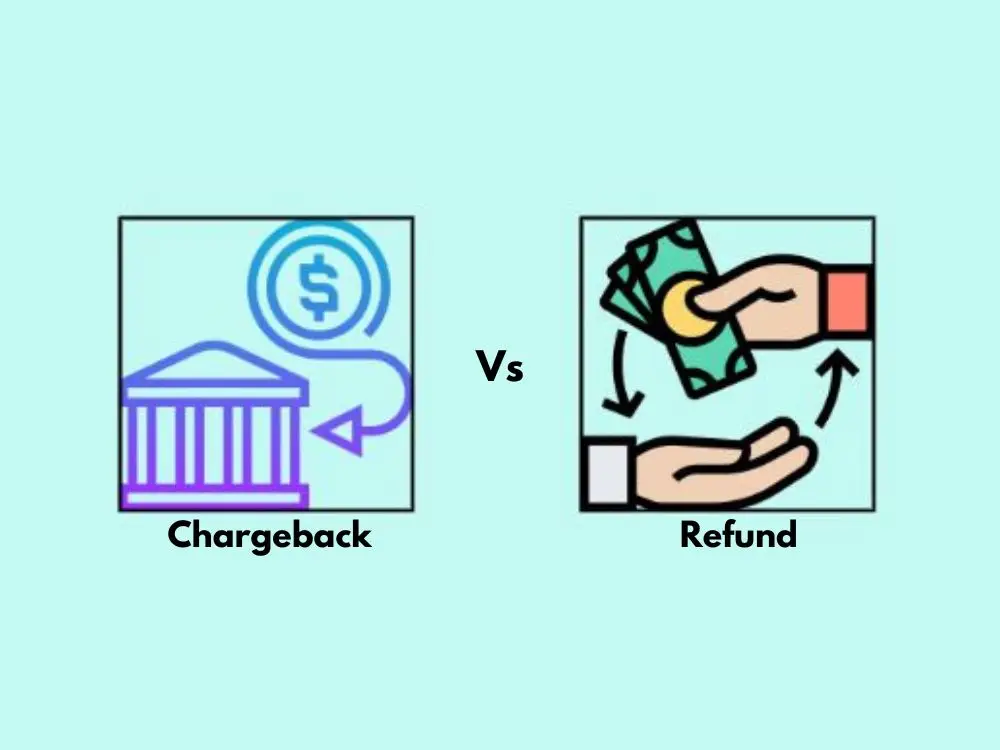

Chargeback vs Refund: Understanding the Differences

Chargeback vs Refund: Key Differences

You have to understand the key differences between a chargeback and a refund to manage your business effectively. Let’s look into it:

Refund: A refund is generally initiated by the merchant. This is when a customer is unhappy with the product they purchased or service rendered to them, they directly contact the merchant to whom they wish to return such item(s) or receive money back whether in whole or part.

So, the merchant understands the customer's request and processes a refund. This is a straightforward way to resolve the customer’s issue. Refunds usually incur fewer costs since there are no extra charges attached and thus promote good relationships with customers.

Chargeback: Unlike refunds, chargebacks are initiated by customers through their bank or credit card issuer. This happens without the merchant’s prior knowledge. Also, this process starts when a consumer disputes a transaction because they believe it is unauthorized, misrepresentation has been done in terms of the product, or else the item was not delivered. Whereas refunds are made directly from merchants.

Chargebacks are made through banks that reverse transactions on behalf of customers. The fact that there are various costs involved and other penalties attached to this may make them worse for businesses. Also, it can affect merchant accounts adversely, especially when it happens regularly.

To understand this in short, refer to the following table, which clearly explains the differences in a nutshell:

Financial Implications of Chargeback vs Refund

Based on a financial perspective, refunds cost less than chargebacks. A refund may mean losing a sale but at least it can protect a merchant from paying for chargeback fees. On the other hand, chargebacks come with higher costs, which include processing fees, penalties, and other potential damage to your merchant account.

Therefore, it is good for a business to opt for refunds over chargebacks when possible. This can help protect your business, and merchant account and at the same time maintain customer goodwill.

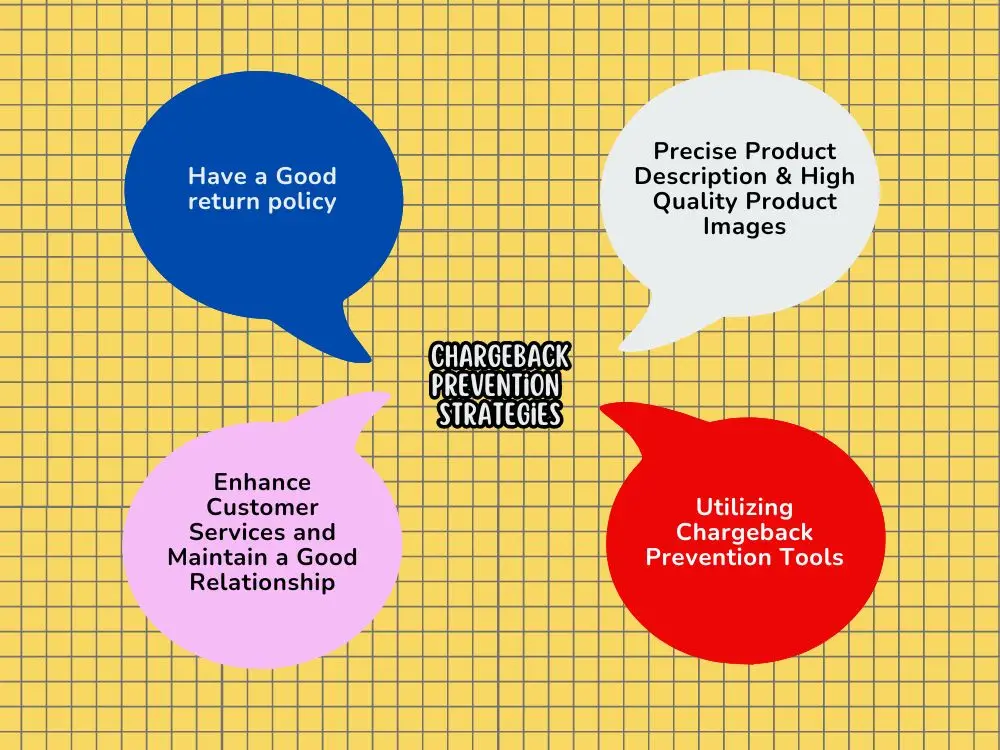

Effective Chargeback Prevention Strategies

Best Practices to Minimize Return Item Chargeback

There are clear and transparent business practices to prevent return item chargebacks. The most effective way is to have a return policy that customers can easily understand.

Apart from that, your product descriptions should be precise and your product images should be of high quality to avoid misunderstandings among customers. Further, excellent customer service also helps before these issues escalate into chargebacks.

Utilizing Chargeback Prevention Tools

Businesses can use many tools and techniques to prevent chargebacks. Some of these include fraud detection systems, chargeback alerts as well as services that help identify potential disputes before they turn into chargebacks.

Therefore, integrating these tools with the payment processing system can help minimize the likelihood of chargebacks occurring. This way your business will be safeguarded from unwarranted losses.

Chargeback Insurance: A Safety Net for Merchants

What Is Chargeback Insurance and Why It Matters

Chargeback insurance is a sort of security option that organizations can possess. Companies in risky sectors must purchase this policy. This is because companies in these sectors often have to deal with multiple chargebacks. Therefore, they are required to acquire chargeback insurance to avoid financial losses.

Moreover, chargeback insurance assists businesses in offsetting costs related to chargebacks like fees and penalties. It also helps merchants in minimizing the risks associated with high chargeback rates. Furthermore, through having this type of security for their business, they will be able to protect themselves from unforeseen circumstances.

Evaluating the Costs and Benefits of Chargeback Insurance

Even though chargeback insurance offers a security net, it is also critical to assess its costs against the benefits it has. Premium rates for chargeback insurance differ based on the chargeback history of your company as well as its risk factor.

Therefore, you must carefully consider whether the potential reduction in chargeback fees and added security offered by the insurance policy makes sense when compared to the amount paid in premiums.

Legal and Regulatory Considerations in Chargebacks

Merchant Rights During a Chargeback Dispute

When it comes to chargeback disputes, as a merchant, you are entitled to certain rights. This knowledge can enable you to contest unfair chargebacks. For example, you might have proof that the transaction was genuine, the product was delivered as described, or the client accepted your returns policy.

If you have these adequate proofs and know how to maneuver through disputes then there are higher chances of winning cases on chargebacks.

Compliance with Chargeback Regulations

It is important to comply with chargeback regulations which ensure your business's safety. This involves keeping accurate records, communicating clearly with customers, and adhering to crucial business standards.

Moreover, you must stay informed about new regulations and best practices which helps you avoid unnecessary disputes and also prepares your business for effective return item chargeback handling.

The Future of Chargeback Management

Technological Advances in Chargeback Prevention

Technology plays an important role in driving chargeback management more than ever before. AI and machine learning advancements help detect and prevent chargebacks on a large scale. You can also use these technological advancements to recognize fraud patterns from transactions.

This alerts you about chargebacks as early warnings. Enhanced versions of these AI tools will increasingly become important in assisting merchants in the control and minimization of chargebacks.

Trends Shaping the Future of Chargeback Regulations

Changes are constantly taking place in the chargeback regulations and business firms should be aware of these changes. These changes include trends such as increasing consumer protection laws, tighter regulations on payment processors, and the globalization of e-commerce that need to be taken into consideration.

Therefore, learning about these trends will aid a business in adapting their strategies and protecting their businesses in the long run.

Final Words

A return item chargeback is a significant challenge for merchants, especially those operating in high-risk industries. It is crucial to know what a return item chargeback is, why it can have negative impacts on businesses, and how to successfully avoid it to achieve stability in finances and preserve the business's reputation.

As a merchant, you must safeguard your firm against return item chargeback and make sure your business thrives for years. To do this, you can obtain chargeback insurance or lower the chances of getting chargebacks through effective strategies that focus on chargeback prevention.

Further, you can understand that there are clear differences between a chargeback and a refund. Plus, the future of chargeback management holds technological advances in chargeback prevention and different trends that shape the future of chargeback regulations.

FAQs

Q1: Can a chargeback be reversed once it’s initiated?

A1: Yes, it is possible to reverse a chargeback when the seller can submit adequate proof to the bank indicating that the transaction was legit. This procedure is referred to as chargeback representation.

Q2: How long does a customer have to file a chargeback?

A2: The customers have different time durations to file a chargeback based on the card issuer. Mostly, they can do it between 60 to 120 days from the date they got into a transaction. Further, for certain disputes, customers might be granted longer periods by some issuers.

Q3: Does a high chargeback rate affect my ability to accept payments?

A3: Yes, if you run a business and your chargebacks are high it will ruin your reputation among the payment processors. If such rates don’t go down then your entity can either be referred to as risky by them or there are higher fees associated and sometimes possible for merchant account termination.

Q4: Are digital products also subject to return item chargeback?

A4: Yes. The chargebacks can be also to digital things like e-books, online services, and software programs. People may complain if they think that the digital item was not as described, doesn’t work, or is unauthorized.

Q5: What should I do if a customer threatens to initiate a chargeback?

A5: If a customer threatens a chargeback, you need to address their concerns promptly. Plus, you can directly offer a resolution for the issue either by providing a refund or an alternative solution. This can help prevent the chargeback process from happening.

Explore Related Articles

https://smarttoolsai.com/post/high-risk-merchant-account-at-highriskpay-com

.webp)