How to Use a Probability Calculator to Understand Risk Assessment in Investment Decisions?

Every investment decision should involve understanding and analyzing risks. Therefore, an investor should always check the risk potential of any asset before making an investment decision. This helps protect them from any possible financial losses.

Probability indicates the likelihood of certain events to happen or not happen. A probability calculator simplifies things and makes it easy for investors to know the likelihood of a risk occurrence and non-occurrence.

This article will detail how to use a probability calculator effectively for assessing risks. Plus it explores its importance in making wise investment decisions.

Key Takeaways

- Understand the types of risks in investments to make smarter decisions.

- Utilize a probability calculator to assess and manage risk effectively.

- Enhance decision-making and navigate markets effectively to achieve investment success.

Understanding Risk Assessment

The Concept of Risk in Investments

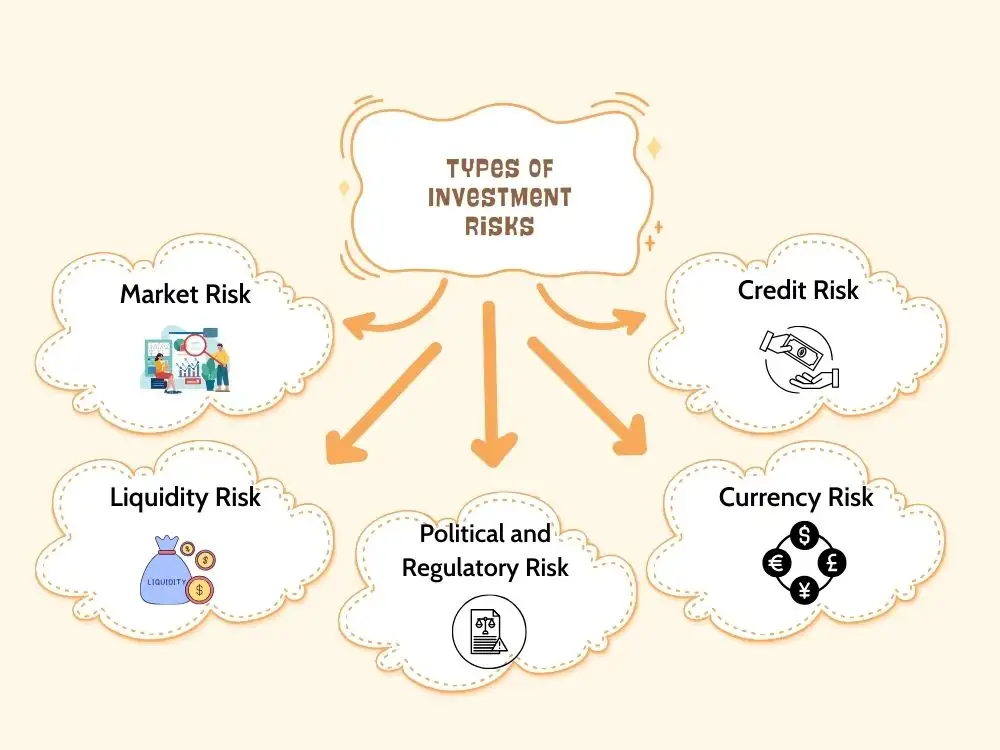

The risk in investment is an uncertain thing that can harm the invested capital partially or fully. There are several factors contribute to investment risk which are identified as follows:

- Market Risk: This type of risk may arise from changes in market conditions. The changes in stock values, inflation, interest rates, and commodity prices are some examples. This may affect all investments to a certain degree and beyond the investors' control.

- Credit Risk: Credit risk is identified as borrowers' failure to repay the debt they obtained. This is relevant for fixed-income investments such as bonds.

- Liquidity Risk: Liquidity is a significant thing in an investment where low liquidity investments are hard to sell quickly. Plus, they cause a substantial loss compared to high liquidity investments.

- Political and Regulatory Risk: The changes in regulations and government policies make a significant impact on investments. Political instability, disputes in trading, and law changes regarding taxes are some examples of this.

- Currency Risk: In other words, it is considered an exchange rate risk. Just think that you invest in a high-value currency for future gains and it goes the negative way by depreciating its value for your local currency exchange. This can cause an investment loss.

Investors should thoroughly understand these investment risk types, which help them make informed investment decisions. Moreover, it involves assessing the probability of risk occurrences and implementing good strategies to safeguard investors from huge losses.

Understand the Probability Calculator

What is a Probability Calculator?

A probability calculator is a tool that is used to find out the likelihood of event occurrences and non-occurrences. In finance, it is used for various aspects such as identifying the profit or loss probability, risk probability, cash flow probability, and many more.

It helps in assessing the likelihood of different outcomes with the help of historical data and statistical models. Also, the probability calculator utilizes mathematical algorithms to find out the chances of different scenarios that occur within a given investment context.

How Does a Probability Calculator Help Find and Manage Investment Risks?

A probability calculator is an effective tool that helps identify investment risks. It simplifies identifying the likelihood of various outcomes based on historical data and with statistical models. Let’s see how it helps:

- Assessment of Potential Outcomes: The tool is useful to generate probability distributions. It shows an investor the range of potential investment outcomes. Also, investors can put relevant events such as asset prices, market volatility, and other aspects to visualize the likelihood of different scenarios.

- Risk Quantification: This is an important function of a probability calculator. It aids investors in finding out the amount of risk and the likelihood of potential loss occurrence or gaining desired returns. This will enable a more solid evaluation of risk exposure that is associated with different investment decisions.

- Scenario Analysis: A probability calculator tool can streamline scenario analysis, where investors can simulate various market conditions and investment scenarios. Further, it assists in analyzing different hypothetical situations. Meanwhile, investors can evaluate the impact of changes in variables like interest rates, economic conditions, or asset prices on their investment portfolios.

- Risk Management: By identifying the investment risk probability, investors can implement appropriate risk management strategies to mitigate potential risks. The tool is very useful to fulfill this purpose. Also, investors can effectively adjust their asset allocation, diversify their investment portfolios, or implement hedging strategies to minimize exposure to specific risks found through probability analysis.

- Informed Decision-Making: With the help of a probability calculator, investors can make informed decisions. It provides data-driven insights into the probabilistic nature of financial markets. This approach helps make strategic investment decisions with lower risk potential.

Overall, we can say that probability calculators are crucial in helping investors identify, assess, and manage investment risks. They provide quantitative measures of uncertainty and facilitate informed decision-making.

Case Study Example

Purpose: Optimizing investment strategies for a Toronto-based financial firm “Enrich Investments”

Company Background:

Enrich Investments is a financial firm based in Toronto, Canada. They do portfolio management and wealth advisory services for their valuable clients. Also, they have a huge client base who are individual investors and corporate clients. They are committed to offering top-notch returns while successfully managing the risk effectively. The firm utilizes AI tools like probability calculators to optimize investment outcomes for its clients.

Scenario:

Enrich Investments mainly focuses on optimizing the investment portfolio for their wealthy individual client. The client is looking to grow their wealth while preserving capital. The client is based in Toronto and has a moderate risk tolerance. Plus, they are seeking a well-balanced approach for the investment that can prioritize long-term growth and income generation.

Utilizing a Probability Calculator:

To meet the client's requirements, Enrich Investments utilizes a probability calculator to assess various investment strategies. The firm considers real-world events across different investment contexts. This helps them match an appropriate strategy that aligns with the client's risk profile and financial goals.

Portfolio Optimization:

Enrich Investments utilizes the probability calculator to assess multiple asset allocation strategies. It considers factors like historical performance, market conditions, and economic outlook. Moreover, it analyzes the probability distributions of potential returns and risks associated with various asset mixes. This approach helps the firm to sophisticatedly identify an optimal portfolio allocation that balances growth opportunities with risk mitigation.

Option Pricing:

In managing the client's portfolio, Enrich Investments incorporates option pricing analysis using the probability calculator. The firm prices options contracts based on probabilistic assessments of future price movements, volatility levels, and option expiration dates. By accurately pricing options, Enrich Investments can enhance portfolio returns and hedges against downside risk.

Risk Management:

Identifying the importance of risk management is the main priority for Enrich Investments. They assess the downside risk and implement risk mitigation strategies properly. Proactive risk management measures such as setting stop-loss orders and diversifying across asset classes are implemented to safeguard the client's capital in adverse market conditions.

Outcome:

Enrich Investments successfully optimizes the investment strategy for the Toronto-based client with the help of the probability calculator and real-world scenario analysis. This approach ensures a well-balanced portfolio that can help maximize returns while managing risk. Additionally, with a complete understanding of investment risks and opportunities, the client can navigate volatile markets with confidence.

Final Thoughts

Understanding the investment risk potential through a proper risk assessment is crucial. It helps make informed investment decisions that have less chance to go wrong. A probability calculator plays an important part in calculating the likelihood of risk probabilities.

There are several risk formats we can identify in the investment context. They are identified as market risk, credit risk, liquidity risk, currency risk, and political and regulatory risk. A probability calculator is useful to find and manage risk effectively. It identifies the likelihood of risk occurrences in the investment margin. Plus, using this metric investors can implement necessary strategies.

FAQs

Q1: How do you calculate the risk probability?

A probability calculator is generally used to calculate the risk probability. It utilizes historical data and statistical models to find out the likelihood of different outcomes in investment scenarios.

Q2: What is risk assessment and how is it helpful?

Risk assessment is a procedure of evaluating the potential risks and implementing proper measures to mitigate them. It helps investors find out investment risks and their weight. Eventually, it aids in making informed decisions.

Q3: Why is it necessary to calculate risk probability?

Calculating the risk probability is essential to understand the likelihood of various outcomes in investment scenarios. This calculation lets investors evaluate the level of risk associated with their investment decisions. So, they can have the chance to implement appropriate risk management strategies to protect their investments from potential losses.

Explore Related Posts

https://smarttoolsai.com/post/risk-management-plan-for-your-high-risk-business

.webp)