How to Create a Risk Management Plan for Your High-Risk Business

Have you ever thought about how some companies easily deal with challenges while others struggle to cope? That is where a good risk management plan becomes crucial for any business where it acts as a protective net.

Imagine that your high-risk business firm is running smoothly until something unexpected happens. Without having a well-established risk management plan, you may find difficulties for proper solutions.

But, if you have a proper plan, it will help you easily spot and face potential risks before they become big issues and you can take necessary actions to keep things on track.

Key Takeaways

- Understand a Risk Management Plan: A proper way to recognize, evaluate, and manage risks and make sure a business remains operational.

- Importance of a Risk Management Plan: Learn why it is essential for navigating regulatory changes, market volatility, and operational challenges.

- Explore Key Components: Find out the critical elements of a risk management plan such as risk identification, assessment, strategies for mitigation, and then monitoring and communication.

- Using Different Templates: Explore various risk management plan templates such as from a basic template to an industry-specific template that can be customized for different business needs.

- Implement the plan Effectively: Understand how you can implement your risk management plan with clear responsibilities, continuous monitoring, and regular updates.

What is a Risk Management Plan?

A risk management plan is a proper way to identify, evaluate, and deal with risks that could mess up a business. For high-risk businesses, this plan is super important because they deal with a lot of challenges like changes in regulations, market ups and downs, and operational issues.

This risk management plan is made to minimize the impact of risks on any business and also ensures that the business can keep going even when things get tough.

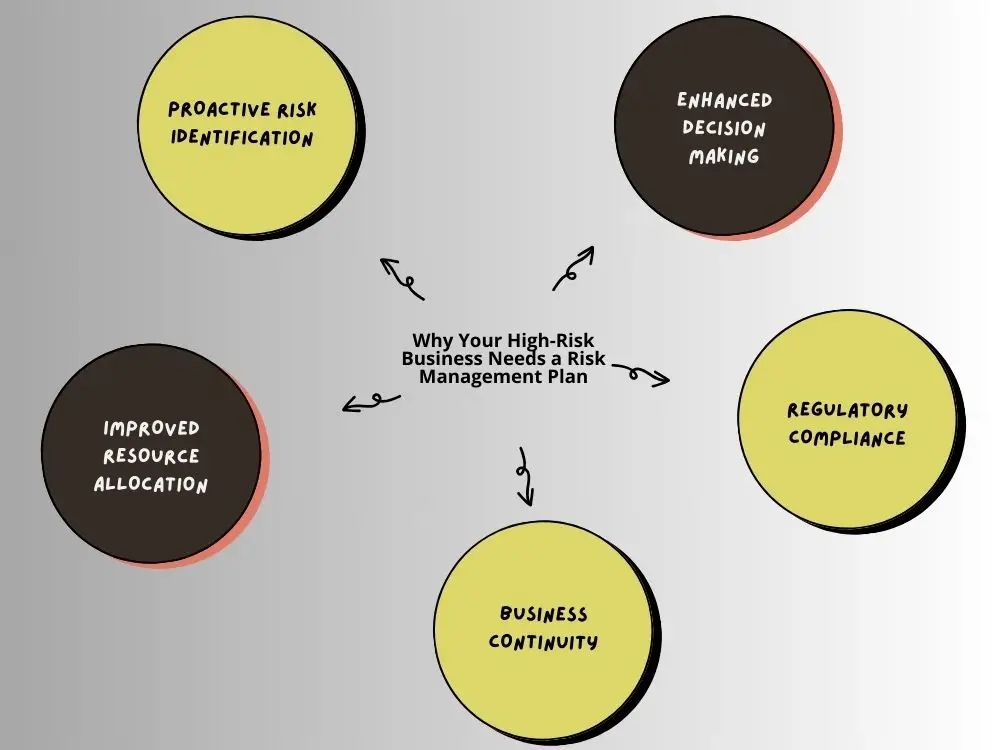

Why Your High-Risk Business Needs a Risk Management Plan

Organizations that are engaged in high-risk business, such as the finance sector, healthcare sector, online services, and many others are prone to greater risk compared to their counterparts that operate in low or medium-risk fields.

These are the industries most likely to face several risks. Whether it is financial downturns, compliance issues, or damage to your company’s reputation, being in these sectors is always an uphill task. For this reason, there is a need for viable measures to control such risks. It aids in several ways such as:

- Proactive Risk Identification: The risk management plan effectively helps identify risks before anything goes wrong. This will allow you to take measures to avoid them or lessen their impact.

- Enhanced Decision Making: A risk management plan provides a comprehensive framework for making decisions in pressure situations.

- Improved Resource Allocation: It also enables you to put resources where they can help minimize the risk well.

- Regulatory Compliance: Many high-risk industries must comply with the regulations set by authorities. It ensures that your business remains within legal limits.

- Business Continuity: During a crisis, a reliable plan for managing your risks ensures that you are prepared to move on with business activities.

Key Components of a Risk Management Plan

There are several key components of a risk management plan that includes:

1. Risk Identification- This is the first step that includes identifying all potential risks that may arise in businesses. Plus, it may encompass any kind of risks such as financial, operational, or reputational.

2. Risk Assessment- Once you have successfully identified potential risks, the next thing to do is to measure the risk probability and how much they will affect your business.

3. Risk Mitigation Strategies- After a risk assessment, you will have a clear idea about the risk likelihood and its severity. So, you will need to come up with proper strategies to mitigate them. This might involve things like proper vendor management, getting insurance, etc.

4. Monitoring and Review- With time, the nature of risks may change. Thus, it becomes essential for organizations to monitor and review risk management approaches with keenness.

5. Communication and Reporting- Last but not least, it is crucial for stakeholders to communicate about and report on risks accurately in a short period. This can be accomplished through using appropriate communication routes as well as reporting software available online.

Different Risk Management Plan Templates

When creating a risk management plan for your high-risk business, you have to use different templates that can save time and ensure consistency. Below are some examples of common risk management plan templates that are presented in a clear tabular format:

1. Basic Risk Management Plan Template

Overview:

Purpose: This kind of template is intended for small businesses or start-ups that pursue an uncomplicated approach to treating risk.

Structure:

- Introduction: A concise overview of the company and why it is necessary to manage risks.

- Risk identification: Find out the potential risks with brief descriptions.

- Risk assessment: A simple matrix where each risk’s probability and impact are assessed.

- Risk mitigation: Basic strategies for dealing with each recognized risk.

- Monitoring & Reporting: Techniques for keeping track of the risks in their workplace environments as well as communicating them with those involved in any way.

Example: A local retail shop might use this template to identify risks like supply chain disruptions or seasonal downturns, with straightforward strategies like diversifying suppliers or running promotions during slow seasons. Here’s an example:

| Cornerstone Retail’s Basic Risk Management Plan | |

| Section | Details |

| 1. Introduction | Brief Overview: Our local retail shop is committed to keeping a consistent and dependable stock of products for our customers. It's really important for us to recognize and handle risks to prevent any issues and keep things running smoothly without interruptions. |

| 2. Risk Identification | List of Potential Risks: * Disruptions in Supply Chain: Delays or failures in receiving products from suppliers. * Seasonal Downturns: Decreased customer activity during certain times of the year. * Technological Failures: Breakdowns or malfunctions in vital business systems. * Regulatory Changes: New business laws or regulations that could affect business operations. |

| 3. Risk Assessment | Evaluation Matrix: * Disruptions in Supply Chain: Likelihood - High, Impact - High. * Seasonal Downturns: Likelihood - Medium, Impact - Medium. * Technological Failures: Likelihood - Low, Impact - High. * Regulatory Changes: Likelihood - Medium, Impact - Medium. |

| 4. Risk Mitigation | Mitigation Strategies: * Disruptions in Supply Chain: Obtain products from multiple suppliers to reduce dependency on a particular vendor only. * Seasonal Downturns: Run targeted promotions during slow seasons to boost sales. * Technological Failures: Invest in reliable backup systems and regularly maintain and check the systems. * Regulatory Changes: Always stay informed about new regulations and adjust business practices accordingly. |

| 5. Monitoring and Reporting | Monitoring Methods: * Hold monthly meetings to review the risk management plan. * Provide stakeholders with a quarterly report on the status of key risks and the effectiveness of mitigation strategies. |

At Cornerstone Retail, we understand the importance of proactively managing risks to safeguard our business and customers. This Basic Risk Management Plan serves as a foundational tool to help us navigate potential challenges and maintain steady operations.

By regularly updating and reviewing this plan, we ensure that we remain resilient and prepared for any uncertainties.

2. Comprehensive Risk Management Plan Template

Overview:

Purpose: This is meant for larger businesses or highly regulated industries that require a detailed and extensive management of risk.

Structure:

- Introduction: Comprehensive profile of the company having its goals and governing laws.

- Risk Identification: An exhaustive list of possible risks by type (such as financial, operational, or reputational).

- Risk Assessment: A thorough risk assessment with both quantitative and qualitative dimensions.

- Risk Mitigation: Far-reaching mitigation with the allocation of duties and timelines to specific individuals.

- Monitoring and Reporting: Sophisticated monitoring methods combined with regular reporting schedules.

Example: A pharmaceutical company may employ this template to tackle dilemmas concerning the production of drugs like adherence to rules, problems related to supply chains, as well as product recalls.

| Pinnacle Pharma’s Comprehensive Risk Management Plan | |

| Section | Details |

| 1. Introduction | Detailed Background: The main goal of our company is to produce medicines which are non-hazardous and efficient. To succeed, we must comprehend the intricate regulatory environment and handle risks effectively that are associated with pharmaceutical making. |

| 2. Risk Identification | Exhaustive Risk List: * Regulatory Compliance: Any changes in FDA regulations may impact drug approval processes. (operational risk) * Supply Chain Issues: Any delays in sourcing raw materials can affect production timelines. (operational, reputational risk) * Product Recalls: The potential need for recalling products due to safety concerns may impact the profit. (financial risk) |

| 3. Risk Assessment | Detailed Risk Assessment: * Regulatory Compliance: Likelihood - Medium, Impact - High. * Supply Chain Issues: Likelihood - High, Impact - Medium. * Product Recalls: Likelihood - Low, Impact - High. |

| 4. Risk Mitigation | Extensive Mitigation Strategies: * Regulatory Compliance: Establish a dedicated compliance team to monitor regulatory changes and ensure compliance. * Supply Chain Issues: Find out relevant alternative suppliers and establish contingency plans for material shortages. * Product Recalls: Implement good quality control measures and develop a crisis management plan. |

| 5. Monitoring and Reporting | Advanced Monitoring and Reporting: Conduct monthly risk review meetings with senior management, quarterly reports to the board, and real-time monitoring of key risk indicators through specialized software. |

Our company understands the significance of a sound risk management plan as far as pharmaceuticals are concerned. The plan assists us in safeguarding our organization and ensures adherence to regulations while maintaining our promises to offer safe and effective pharmaceutical goods.

Further, we keep a close eye on this plan and update it regularly to stay on top of any potential risks and keep doing well in this tough industry.

3. Project-Specific Risk Management Plan Template

Overview:

Purpose: This is a template specifically for projects that entail project-specific risk management. Such risks can only be dealt with by businesses handling large projects separately from their general business tasks.

Structure:

- Project Overview: The project description, its objectives, and timeline.

- Risk Identification: The potential risk possibilities specific to the project, such as timeline delays or budget overruns.

- Risk Assessment: Evaluation of identified risks in the project.

- Risk Mitigation: Certain strategies are followed according to the project’s needs with a focus on mitigating the risks.

- Monitoring and Reporting: Continuous risk monitoring in the project with project milestones.

Example: A construction company might use this template to manage the risks associated with building a new facility, and perform good construction management with minimal risks.

| ABC Construction’s Project-Specific Risk Management Plan | |

| Section | Details |

| 1. Project Overview | Project Description: Our construction firm is starting a new project for constructing a completely new commercial center. The purpose of this project is to provide the latest office complex in 18 months while meeting all the security and quality requirements. |

| 2. Risk Identification | Project-Specific Risks: * Timeline Delays: Potential delays due to adverse weather conditions. * Budget Overruns: Unexpected increases in material costs or labor expenses. * Regulatory Changes: New zoning laws or regulations that could affect project approvals. |

| 3. Risk Assessment | Project-Specific Risk Matrix: * Timeline Delays: Likelihood - Medium, Impact - High. * Budget Overruns: Likelihood - High, Impact - Medium. * Regulatory Changes: Likelihood - Low, Impact - High. |

| 4. Risk Mitigation | Effective Mitigation Strategies: * Timeline Delays: To mitigate delays, establish contingency plans such as flexible work schedules or additional resources. * Budget Overruns: To avoid overruns, secure fixed-price contracts with suppliers and monitor closely costs incurred. * Regulatory Changes: Engage with local authorities early in the process to anticipate and address any potential barriers from regulations. |

| 5. Monitoring and Reporting | Continuous Monitoring Aligned with Milestones: Develop an ongoing monitoring process for risks that are aligned with project milestones. Hold frequent progress meetings for assessing the status of risks, milestone-based reporting to project stakeholders, and modifications of the mitigation strategies when necessary. |

In our construction company, we understand that every project has its own unique set of challenges and risks. This Project-Specific Risk Management Plan is useful for us to meet these risks effectively. Also, we can achieve our project objectives within the required time frames and budget limitations.

We guarantee that using risk management strategies in line with the timelines adopted during a project will yield successful results for our clients.

4. Industry-Specific Risk Management Plan Template

Overview:

Purpose: Specifically designed for industries like finance, health care, or technology that have their own characteristics in terms of risk.

Structure:

- Industry Overview: A contextual background about the specific risks of an industry.

- Risk Identification: Identifying risks unique to an industry (for instance, compliance risks in health care).

- Risk Assessment: Industry-focused methods of assessing risks.

- Risk Mitigation: Compliance with industry standards and regulations strategies.

- Monitoring and Reporting: Regular reporting according to industry compliance requirements.

Example: This kind of template may be used by a fintech firm to address data breaches, regulatory changes as well as financial frauds.

| SecureFin Tech’s Industry-Specific Risk Management Plan | |

| Section | Details |

| 1. Industry Overview | Contextual Background: Our company operates in a tightly regulated domain where payment processes, adherence to legal frameworks, and preventing fraud or chargebacks are paramount. Therefore, it is vital to keep observing these industry-specific adversities for trust maintenance and operational soundness. |

| 2. Risk Identification | Industry-Specific Risks: * Data Breaches: Unauthorized access to private customers’ information. * Regulatory Changes: New financial regulations that could impact operations. * Financial Fraud: Risks associated with fraudulent transactions or activities. |

| 3. Risk Assessment | Industry-Focused Risk Assessment: * Data Breaches: Likelihood - Medium, Impact - High. * Regulatory Changes: Likelihood - High, Impact - High. * Financial Fraud: Likelihood - Medium, Impact - Medium. |

| 4. Risk Mitigation | * Data Breaches: Incorporate highly advanced encryption as well as regular safety examinations and multi-factor authentication. * Regulatory Changes: Have a compliance team on hand to oversee and adjust to emerging compliance. * Financial Fraud: Utilize AI-based tracking systems capable of identifying and eliminating fake transactions. |

| 5. Monitoring and Reporting | Compliance-Aligned Monitoring and Reporting: Monthly compliance reviews, regular audits, and continuous monitoring of key risk indicators, with reports generated for regulatory bodies and internal stakeholders as required. |

At SecureFin Tech, we understand how important it is to handle the specific risks that come with being in the fast-changing fintech industry. Our plan for managing industry-specific risks is designed to tackle the unique challenges we encounter and make sure we stay compliant, secure, and strong.

By sticking to industry standards and keeping an eye on potential risks, we are dedicated to safeguarding our business and our customers.

Selecting the Right Template

When you choose a template, always consider factors such as business size, degree of operation complexity, and specific risks you face. For small businesses, a basic template might be sufficient while larger enterprises or those in regulated industries might require a more comprehensive template.

Choosing the right risk management plan template is based on several factors:

- Size of Your Business: A basic template might work best for smaller start-ups but larger organizations would use either comprehensive or industry-specific ones.

- Complexity of Operations: Businesses that deal with complex projects or operate within very controlled environments then it require more advanced templates.

- Specific Risk Profile: You must evaluate what kinds of risks your business could most likely face. There are certain times when a project-specific template is used. For example, a project-specific template is ideal if you are managing large-scale projects.

- Regulatory Requirements: If your industry has specific regulatory requirements, choose a template that aligns with those obligations.

- Assigning responsibilities: Specify clearly who will monitor, report, and mitigate the various risks involved.

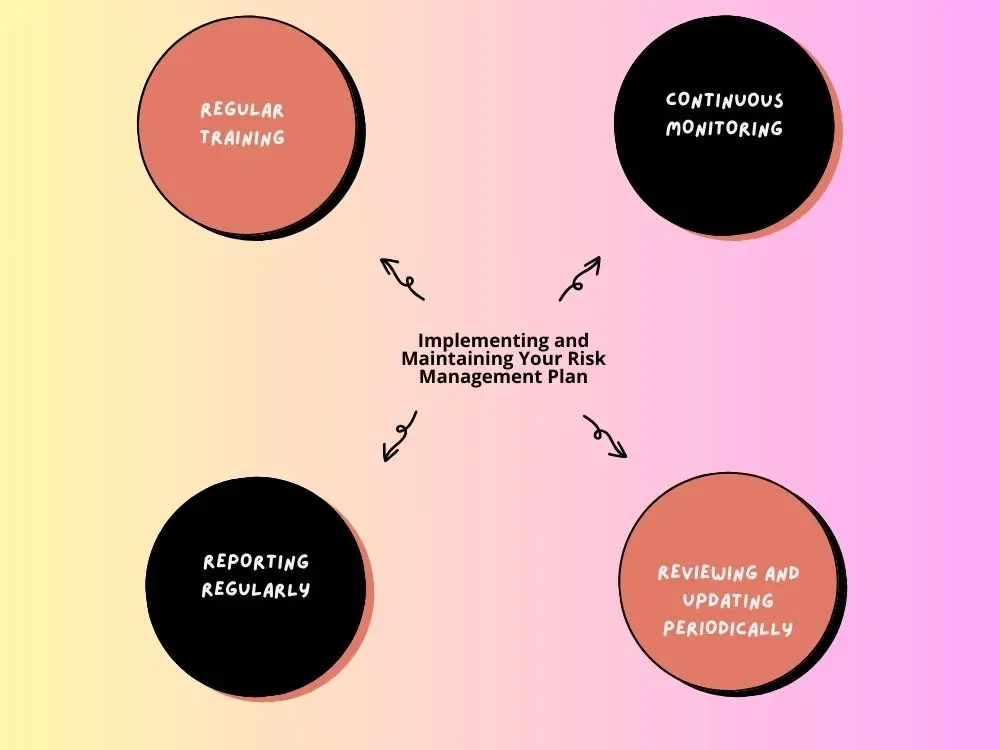

Implementing and Maintaining Your Risk Management Plan

After choosing and customizing the template to fit your business, the next is the implementation step. Effective implementation and maintenance of a risk management plan can be achieved by taking the following steps:

- Regular training: Ensure each member of the team understands thoroughly what the risk management plan is all about, including their own responsibilities therein. Training can help enhance employee strengths in successfully managing risks.

- Continuous monitoring: It should be noted that risks are not fixed situations but instead develop over time. Therefore, review your strategy periodically so that it may fit into the changing business environment.

- Reporting regularly: Stakeholders must be kept updated via routine reports containing information regarding certain identified types of risks and how they have been mitigated immensely.

- Reviewing and updating periodically: The risk management strategy should be reviewed at intervals to ensure its current relevance and usefulness.

Final Words

Creating a risk management plan is helpful for any high-risk business that is looking to protect itself from unexpected challenges. Understanding the basic parts of a risk management plan and applying the right template can help you develop an overall approach to identifying, evaluating, and mitigating risks.

Moreover, you must regularly update and maintain this plan which will help your business navigate uncertainties and continue to thrive in a competitive environment.

FAQs

Q1: What is the first step in making a Risk Management Plan?

A1: The first step is to identify the specific risks your business faces. It includes both internal and external threats that could affect the operations, compliance, and finances.

Q2: How often should I review my Risk Management Plan?

A2: You need to review it every quarter or whenever there are significant changes in your business environment. This guarantees that your risk strategies remain relevant and effective.

Q3: Is it necessary to have a different plan for each business operation?

A3: Not really. You can have one comprehensive plan, but with specific sections that address different unique risks of various operations in your business.

Q4: What is the greatest advantage of having a Risk Management Plan?

A4: The main advantage is to prepare your business against risks which minimizes possible losses. In this way, you can ensure that it is running smoothly even when unexpected challenges arise.

Explore Related Articles

https://smarttoolsai.com/post/high-risk-merchant-account-at-highriskpay-com

https://smarttoolsai.com/post/from-idea-to-success-crafting-a-business-plan-that-works

.webp)