Exploring High Risk Merchant Account at HighRiskPay.com: What You Need to Know

Running a business in our current era of fierce competition isn't easy. If your business falls under the "high risk" category, this becomes even more difficult. This is because high-risk merchants have difficulties in finding proper merchant accounts for payment processing and transactions. Therefore, they need a high-risk merchant account for smoother online transactions.

Imagine that you have to pay exorbitant fees just because you want to operate a company or face limited payment options along with various levels of scrutiny. Sounds tough, right? But with proper support and solutions, high-risk ventures can eliminate this problem and thrive.

This article would serve as a guide for understanding the high-risk merchant account. Further, we will look at their importance, the unique challenges posed by them, and how HighRiskPay.com can be the lifeline that you require.

In essence, what matters is having the right partners and tools in place that could promote your success. The site of HighRiskPay.com has the professionalism and support needed for your business to overcome barriers and expand without limits.

Let’s explore how you can turn these challenges into opportunities to establish a long-term sustainable enterprise.

Key Takeaways

- Understand what a high-risk merchant account is and the essentiality of this account for high-risk businesses.

- Learn about the vital characteristics and challenges faced by high-risk businesses such as high chargeback rates, higher fees, etc.

- Identify how HighRiskPay.com offers high-risk merchant account solutions, including quick approval and many other services such as payment gateway integration, chargeback management, etc.

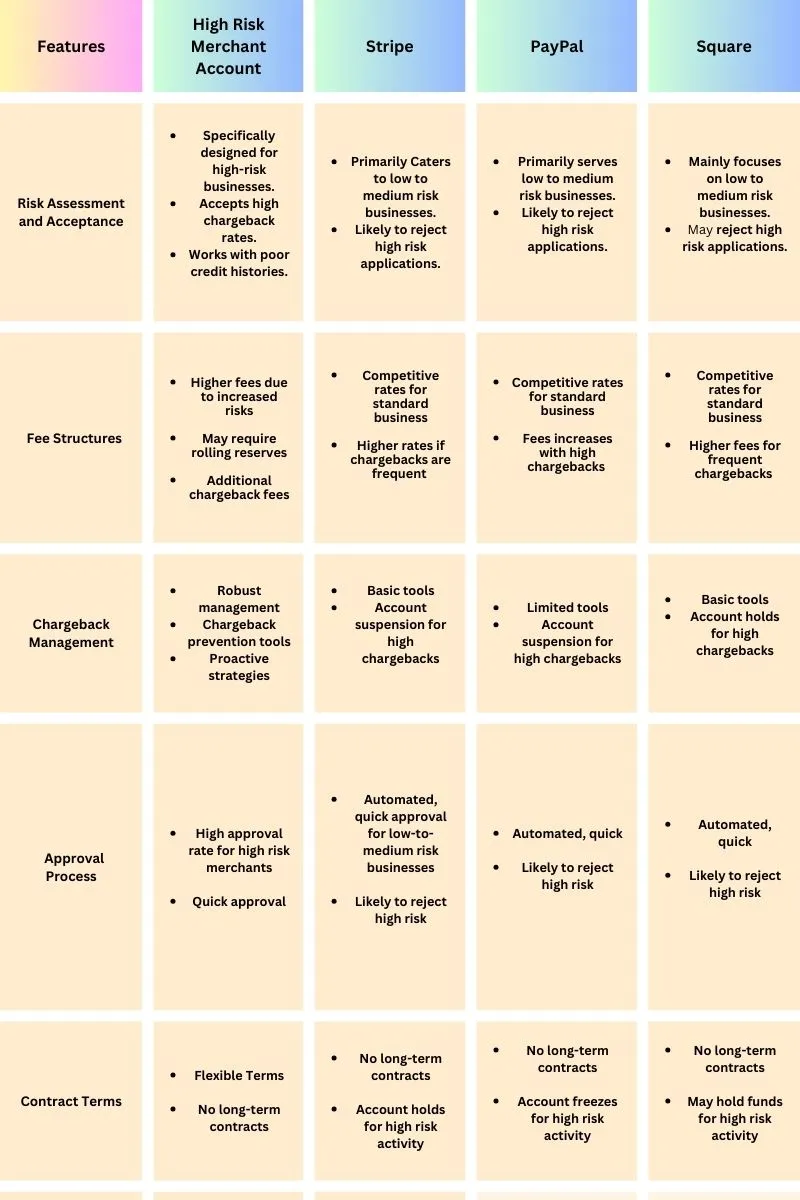

- Identify other alternative high-risk merchant account providers for HighRiskPay.com such as Durango, PaymentCloud, Soar Payments, SMB Global, and Payline Data. Plus compare the differences between high-risk merchant accounts and standard payment gateways like Stripe, PayPal, and Square.

Understanding the High-Risk Merchant Account

What is a High-Risk Merchant Account?

A high-risk merchant account is a specialized payment processing account for businesses that are mostly considered risky by financial institutions such as banks and payment processors. These accounts are helpful to handle the unique challenges faced by these risky businesses.

In addition to this, it also ensures that they can process online credit card or debit card transactions efficiently and securely.

Characteristics of High-Risk Businesses

Certain criteria classify a business as high-risk. These include:

- High chargeback rates: A chargeback means returning money to the payer of a transaction, especially in cases where it involves credit or debit card transactions. The payer is usually a consumer. Frequent disputes and refunds (chargebacks) can mark a business as high risk.

- Industry type: Some critical industries like telemarketing, firearm providers, and travel services, are known as high-risk.

- Credit history: When a Business has poor credit history then it may be classified as high risk.

- High transaction volumes: Companies processing large volumes of transactions can also be identified as high risk. For example, software subscription services.

Common Industries

Several industries are typically classified as high-risk due to their nature. These include:

- Travel services

- Telemarketing

- eCommerce selling high-ticket items

- Subscription-based services (SaaS)

- Nutraceuticals and supplements

- Dating sites

- Firearm Dealers

- Online Pharmacy

- Ticket Brokers

- Drop shipping

Reasons for High-Risk Classification

Understanding why a business is classified as risky can help manage the associated challenges. High-risk classifications often arise from:

- High Number of Chargebacks: Frequent chargebacks from customers may indicate a higher likelihood of disputes and refunds. Generally, banks and payment processors consider businesses high risk if they have more than 1% chargebacks.

- Product or Service Types: Businesses that sell products or services that generate inconsistent revenues. This means banks or payment processors flag these businesses as risky due to their inconsistent income-generating product or service types. For example, seasonal items, event tickets, and software.

- Regulatory Concerns: Strict regulations or legal uncertainties for some industries are reasons for considering high risk.

- Reputational Risk: Businesses with a history of fraud or financial instability can be classified as high risk. Also, businesses dealing with more sensitive customer information is also a reason for reputational risk.

- Recurring Payments: The businesses that work on a subscription model are often charged with higher rates of occurrences for chargebacks, frauds, and identity theft. Payment processors find these types of models riskier because there is an increased chance of customer disputes or account takeovers.

- Credit Score: When businesses have poor credit scores, it can be another reason for being classified as high risk. Financial institutions are less likely to work with businesses that have lower credit scores because these scores indicate that they may struggle to fulfill their financial obligations or become financially unstable.

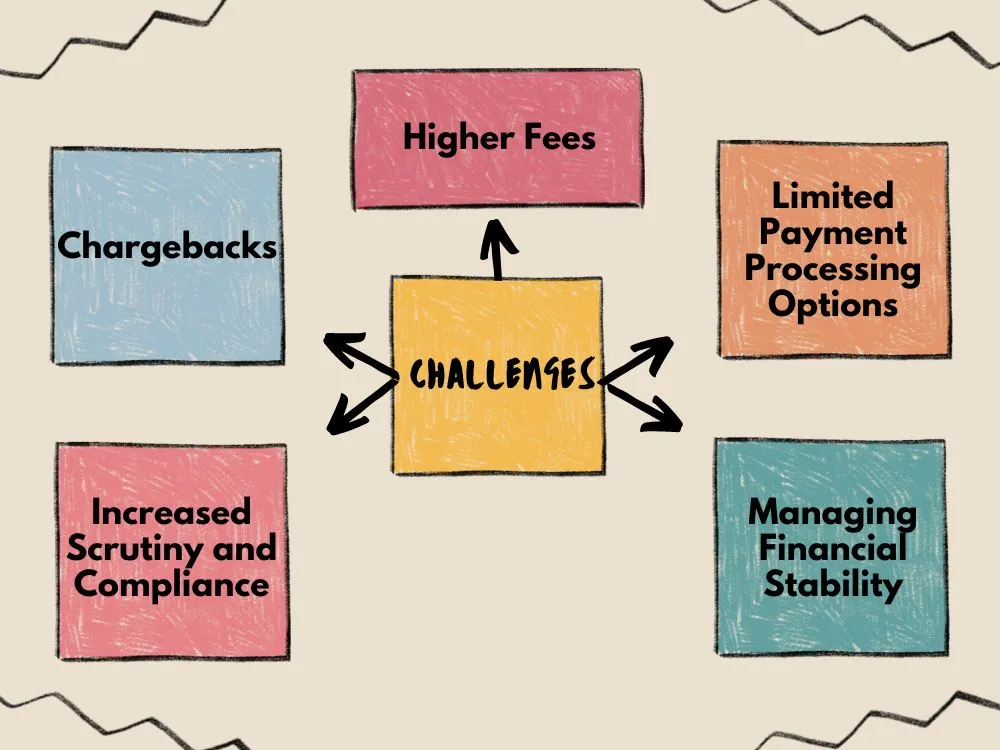

Challenges Faced by High-Risk Merchants

Higher Fees

In comparison with low-risk companies, high-risk merchants are charged more. The purpose behind these charges is to compensate for elevated transaction processing costs and create backup deposits for possible chargebacks and fraud.

Limited Payment Processing Options

Usually, high-risk merchants have a hard time finding banks or payment processors. This is due to their risky business nature, with a higher chance of fraud and chargebacks.

Chargebacks

Chargebacks or return item chargebacks are a significant challenge for high-risk businesses. It occurs when customers dispute transactions and request the reversal of funds. If a lot of chargebacks occur, it can really hurt a company's reputation and result in higher fees and tougher terms from payment processors.

Increased Scrutiny and Compliance

High-risk merchants also face increased scrutiny from financial institutions and regulatory bodies. They must adhere to important and strict compliance requirements. This includes good fraud prevention measures and regular audits.

Managing Financial Stability

Maintaining financial stability is crucial for high-risk businesses. The challenges of higher fees, limited processing options, and chargebacks can strain cash flow and financial health.

Introduction to HighRiskPay.com

Company Overview

HighRiskPay.com specializes in providing payment processing solutions for high-risk businesses with bad credit. Businesses that fall under the high-risk category need an online transaction method, but banks and payment processors are hesitant to approve them because of their risky nature.

HighRiskPay.com eliminates this issue and they have years of experience and expertise in doing this. Plus, the company understands the unique challenges faced by these businesses and offers matching solutions to address their needs.

Mission and Vision

The mission and vision of HighRiskPay.com is to enhance the approval rate of high-risk businesses for a merchant account that provides them with safe, dependable, and fast payment processing options.

They invest heavily in ensuring no merchant fails due to a lack of financial services irrespective of their risk category. Their goal is to break down barriers for businesses to make it easier for them to proliferate without any obstructions or delays. Plus ensure approval rates as high as 99 % in just 24 hours with no paperwork involved apart from online forms only.

Additionally, simplicity, universal acceptance, and strong chargeback prevention are some factors that demonstrate the company’s commitment to your success.

Unique Selling Points

HighRiskPay.com has various unique qualities that make it stand out among its competitors. Here are some of these features:

- High Approval Rates: The organization assists in achieving a high level of success in obtaining merchant accounts for risky businesses.

- Competitive Pricing: HighRiskPay.com provides affordable price and tariff choices suitable for high-risk merchants.

- Sophisticated Risk Administration: They possess modern state-of-the-art risk management mechanisms to avert fraud and deal with chargebacks effectively.

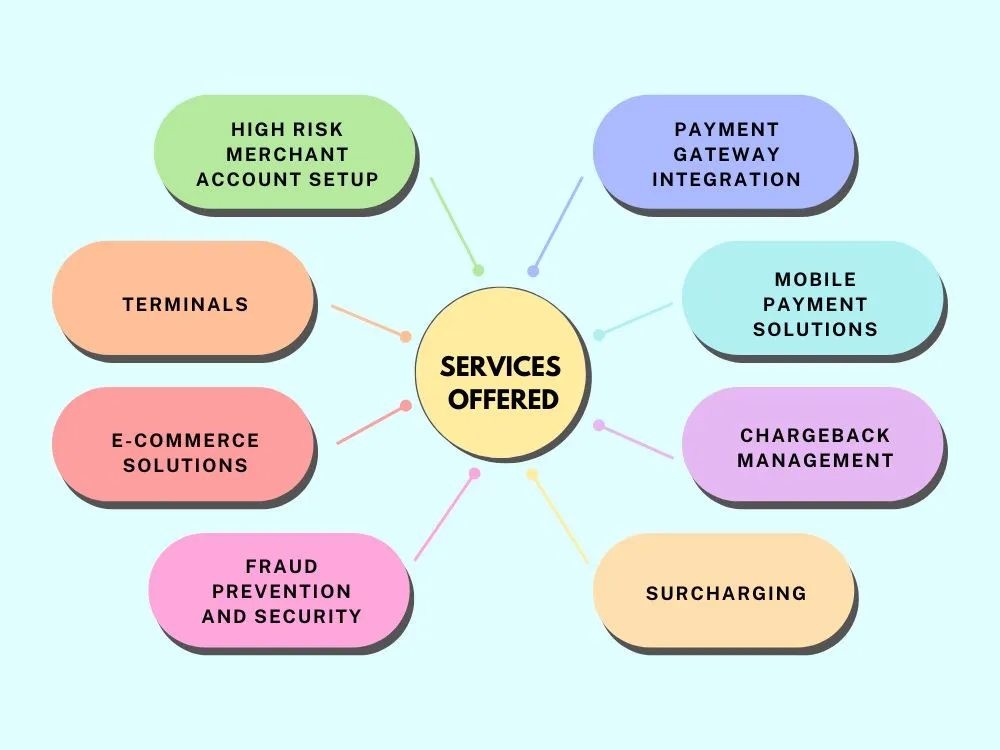

Services Offered by HighRiskPay.com

1. High-Risk Merchant Account Setup

Setting up a high-risk merchant account with HighRiskPay.com is simple. They offer comprehensive assistance to businesses during the application stage and ensure that all the needs are met. Additionally, they offer a helping hand at every point of the journey.

2. Payment Gateway Integration

HighRiskPay.com provides seamless integration across a range of online e-commerce platforms with its sophisticated payment gateways. These gateways are intended for managing huge volumes of transactions and enabling several payment options to guarantee the secure and effective processing of payments.

3. Terminals

HighRiskPay.com has cutting-edge payment terminals for businesses requiring in-person payment solutions. Plus, these terminals are equipped with the latest technology to ensure secure and swift transactions.

4. Mobile Payment Solutions

Mobile payment solutions are provided by HighRiskPay.com for businesses that are constantly on the move. By using these methods, they can process payments using mobile devices. This particular service adds flexibility and convenience for retailers as well as clients.

5. E-commerce Solutions

HighRiskPay.com supports online businesses with comprehensive e-commerce solutions. These include vital tools and integrations that help simplify online payment processing. Plus, it ensures a smooth and secure checkout experience for customers.

6. Chargeback Management

The company provides comprehensive chargeback management services. It helps businesses reduce chargebacks through proactive monitoring and dispute resolution. This helps minimize financial losses and protect the business's reputation.

7. Fraud Prevention and Security

HighRiskPay.com takes security very seriously. For this reason, they have been using various strategies that help avoid any fraud and make the most out of their transactions online. This includes real-time monitoring of transactions, encrypting information using sophisticated techniques, and multi-layer authentication.

8. Surcharging

The company offers surcharging solutions that let businesses transfer the burden of credit card processing fees onto clients. This may enable organizations to control the running costs adequately, particularly in risky surroundings.

9. Payment Processing

The company supports many payment methods. This includes credit and debit cards, eChecks, and other alternative payment methods. This flexibility ensures that businesses can cater to their customer's preferences and expand their market reach.

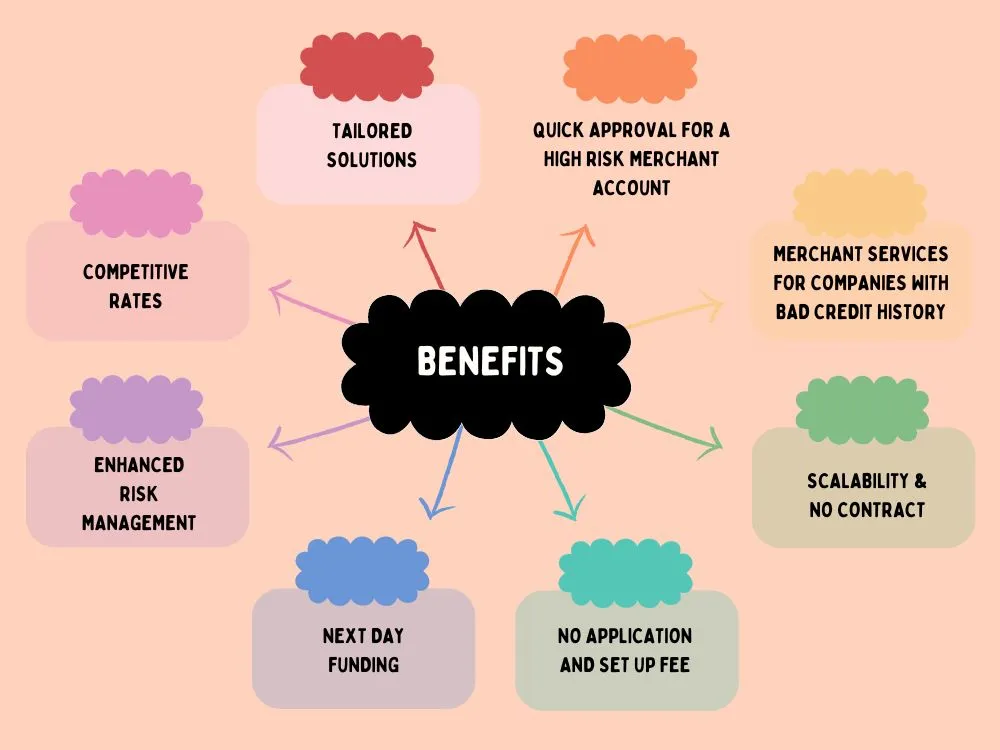

Benefits of Using HighRiskPay.com

A. Tailored Solutions

The company provides customized solutions based on each business's unique needs. Whether it's handling high transaction volumes or managing chargebacks, it offers tailored services to meet specific requirements.

B. Quick Approval for a High-Risk Merchant Account

Usually, the approval of a high-risk merchant account takes some days or weeks. But at HighRiskPay.com it is possible to get you approved quickly. This means the company tries its best and typically gets your account approved in 24 to 48 hours.

This is particularly faster than many other high-risk merchant account providers. Plus, the company also ensures a 99% approval rate which means that you will be approved for sure and can quickly initiate accepting payments.

C. Competitive Rates

Many merchant account providers charge higher fees for merchant accounts but HighRiskPay.com offers competitive pricing. The company's fee structures are transparent and provide value for money.

D. Merchant Services for Companies with Bad Credit History

The company provides services for businesses with bad credit history. Generally, these types of companies struggle to get approved but with the help of HighRiskPay.com, this can be easy. They ensure merchant account approval for companies even when they have a bad credit history.

E. Enhanced Risk Management

The company uses advanced risk management tools that help mitigate fraud and chargebacks. These tools can assist businesses in managing their risk effectively. Plus, it ensures financial stability and protects business reputation.

F. Scalability

HighRiskPay.com comprehensively supports business growth and scalability. As businesses expand, the company provides the necessary infrastructure and support to handle increased transaction volumes and operational demands.

G. Next Day Funding

The company ensures next-day funding. This is crucial for maintaining cash flow and financial stability for businesses.

H. No Contract

HighRiskPay.com does not require long-term contracts. This provides greater flexibility for businesses to use their services without being locked into lengthy commitments.

I. No Application and Set up Fee

The company doesn't request an application fee from applicants. This makes it more accessible for businesses to start the application process without upfront costs. Additionally, there are no setup fees required from firms which allows businesses to save on initial costs and get started quickly.

How to Get Started with HighRiskPay.com

The procedure to start is simple. If you are a business owner, all you have to do is just follow the simple procedures they request and you are good to go. Let's see how you can get started

Application Process

Companies planning to establish a high-risk merchant account start by signing up using a form that is available on the official HighRiskPay.com web page. The form requires respondents to provide their names, emails, phone numbers, and website URLs.

Once done, the company then contacts the business owner with the relevant application instructions and demands.

Required Documentation

The company requires specific documentation to process applications. This typically includes business registration documents, financial statements, and details of previous payment processing history.

Approval Timeline

The approval for a high-risk merchant account is much quicker than other merchant account providers and most applications are processed within 24 to 48 hours. This allows businesses to start accepting payments as soon as possible.

Tips for a Smooth Application

In order to ensure a smooth application process and swift approval, companies must follow these things:

- Provide accurate and complete information on the application form.

- Submit all required documentation promptly.

- Be transparent about their business operations and transaction history.

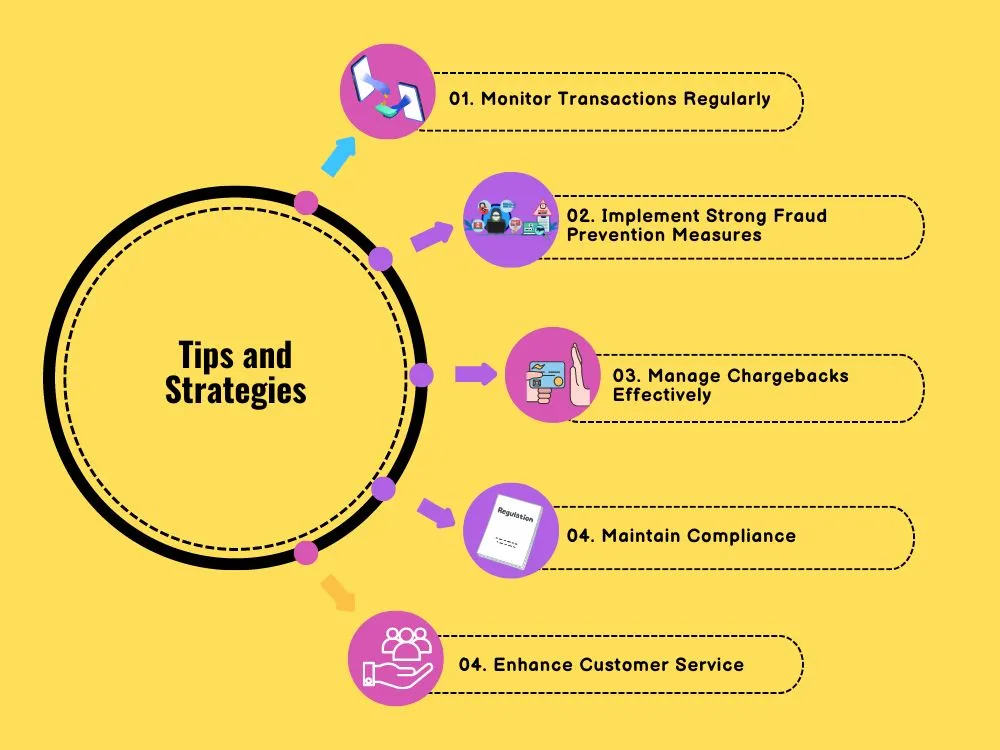

Tips and Strategies for Managing a High-Risk Merchant Account

Monitor Transactions Regularly

Merchants need to monitor their transactions regularly. This may effectively help them in identifying and preventing fraud early. Further, it reduces the risk of chargebacks and financial losses.

Implement Strong Fraud Prevention Measures

It is a crucial thing to set up strong fraud prevention measures. HighRiskPay.com offers necessary tools like real-time transaction monitoring and multi-layer authentication that help businesses safeguard their transactions.

Manage Chargebacks Effectively

Business firms should manage their chargebacks effectively and this is so important to ensure good financial health. In this case, HighRiskPay.com helps businesses reduce and manage chargebacks through proactive monitoring and dispute resolution.

Maintain Compliance

Adhering to industry regulations and standards is another important aspect for high-risk merchants to maintain compliance. For this, HighRiskPay.com helps ensure that all businesses meet necessary requirements and protects companies from operational disruptions and legal penalties.

Enhance Customer Service

By improving customer service businesses can reduce disputes and chargebacks. Moreover, focusing on things like clear communication, timely responses, and quick resolution for customer problems are helpful to maintain a positive reputation.

Other Reputable High-Risk Merchant Account Providers

Highriskpay.com serves several merchants. However, there are many other options that would suit your needs in this regard. Some of the well-known providers of merchant accounts include:

1. Payline Data

Payline Data is a good alternative that specializes in offering high-risk merchant accounts. Their rates are competitive and have robust security features. Moreover, they offer personalized support and a variety of payment processing options.

2. Durango Merchant Services

This company is particularly well-known for its high approval rates and tailored solutions for risky industries. They offer flexible terms, chargeback management, and 24/7 customer support. They also serve 100s of high-risk industries such as pawn shops, fantasy sports, insurance, live animal sales, etc.

They also offer different services such as credit card processing, e-commerce gateway, e-check payments, euro pages, cryptocurrency payments, and chargeback and fraud solutions.

3. PaymentCloud

PaymentCloud not only focuses on high-risk merchant accounts but also offers tailored solutions to low to medium-risk businesses. They provide a fast and straightforward application process. Plus, they offer next-day funding, fraud protection, and a range of payment options.

4. Soar Payments

Soar Payments claims them as a credit card processing leader for high-risk merchant accounts. They also work with multiple industries from low to high risk. They also have transparent pricing and quick approval times. Additionally, they provide comprehensive integration, fraud prevention tools, and personalized customer service.

5. SMB Global

SMB Global is another specialized company that offers high-risk payment processing. It offers competitive rates and a wide range of services that include international payment processing, business loans, ACH payments, and chargeback management.

These are some popular alternatives to HighRiskPay.com which can be considered based on specific business needs and preferences. Further, it ensures that high-risk merchants have multiple options to secure reliable payment processing services.

How Does a High-Risk Merchant Account Differ from Stripe, PayPal, and Square

It is crucial to understand the differences between a high-risk merchant account and standard payment gateways like Stripe, PayPal, and Square. This is important for businesses operating in high-risk industries. The table below highlights the key differences:

Essentially, if your company is not in a high-risk industry, Stripe, PayPal and Square are perfect choices. Conversely, if your business is risky then you need to take a high-risk merchant account like the one provided by HighRiskPay.com.

They have unique services, excellent chargeback handling as well as other adaptable stipulations which cater to such businesses. With high approval rates, competitive rates, and advanced risk management tools, highriskpay.com is the partner you need to navigate the complexities of merchant accounts.

Final Thoughts

A high-risk merchant account holds significant importance for enterprises that have been categorized as risky because of many reasons like high chargeback rates, critical industry types, regulatory constraints, etc. Such organizations encounter various hardships including increased costs (fees), restricted methods for receiving payments, and much closer examination and high scrutiny.

Therefore, HighRiskPay.com helps offer tailored solutions to address these challenges. It provides essential services like high-risk merchant account setup, fraud prevention, chargeback management, 24/7 customer support, etc.

If your business is classified as high-risk and you are struggling with payment processing challenges, you need this account. With high approval rates, competitive rates, and advanced risk management tools, HighRiskPay.com is the partner you need to navigate the complexities of merchant accounts.

In addition, you have several other alternative options that too provide effective merchant accounts and other essential services. When choosing the correct one, you just need to go through some background research and user reviews that may help you choose the best company to set up your merchant account.

FAQs

Q1: What is a high-risk merchant account?

If a business is considered risky then banks and payment processors won't offer them payment processing systems. Therefore, these businesses need a merchant account for online card transactions and some companies like HighRiskPay.com offer this type of account.

Q2: Why is my business considered high-risk?

If your business is considered high-risk, there can be several reasons. Factors like high chargeback rates, industry type, poor credit history, high transaction volumes, and regulatory concerns are some reasons.

Q3: What are the main challenges faced by high-risk merchants?

The primary challenge is to get approved for a merchant account. This is crucial for online transactions. Apart from that, they also face high chargebacks, high scrutiny, and several other challenges.

Q4: How does HighRiskPay.com help high-risk businesses?

The company helps these types of risky businesses to easily get approved for a merchant account. So, they can easily accept payments from their customers. Moreover, it also offers several other services like payment gateway integration, fraud prevention, and chargeback management.

Explore Related Articles

https://smarttoolsai.com/post/how-fake-phone-numbers-prevent-fraud-in-high-risk-businesses

.webp)