Merchant Fraud Protection: How to Safeguard Your Business from Emerging Threats

Is your business ready to face the rising threats in merchant fraud protection? As a business owner, you should know how to protect it from possible fraud or threats. Because e-commerce businesses and digital payment options have been continuously increasing.

So, fraudsters use advanced methods that make their actions even more complex and difficult to discover. Therefore, firms, especially those regarded as high-risk merchants, must follow strong merchant fraud protection practices.

If businesses fail to take appropriate measures, then the consequences in terms of finances or reputation may be devastating. So, you must always be one step ahead of the fraudsters to protect your business.

Key Takeaways

- Understand and be aware of evolving fraud tactics like phishing, account takeovers, synthetic identity fraud, and friendly fraud that can harm your business.

- Learn vital strategies like powerful authentication methods, such as MFA and tokenization, and other tactics like risk assessment, employee education, and sophisticated fraud detection tools, such as Artificial Intelligence and machine learning to ensure merchant fraud protection.

- Know how to align your fraud prevention strategies with regulatory requirements like PCI DSS and GDPR to protect payment and personal data.

- Utilize secure payment gateways, blockchain technology, and Smart Tools AI’s password management tools to ensure your business’s defense against fraud.

Understanding Emerging Fraud Threats

Merchant fraud has taken on new forms as cybercriminals continuously adapt their tactics. Here are some of the most significant emerging threats businesses face:

Phishing and Social Engineering

Generally, phishing attacks involve fraudsters impersonating legitimate organizations when sending emails, text messages, or other methods. They steal your sensitive information, such as login credentials or payment details.

On the other hand, social engineering takes this a step further by manipulating people to disclose private details. Both methods are becoming more frequent where cyber criminals utilize emails, phone calls from fake numbers, and even social media to trick merchants and their employees.

Account Takeover (ATO)

This term refers to a crime committed by fraudsters who gain illegal access to another person’s merchant account. They obtain login details without permission or through hacking.

Once such fraudsters get access, they can carry out unnecessary transactions, alter essential account settings, or grab any important pieces of data. This may result in enormous monetary losses and loss of reputation as well.

Synthetic Identity Fraud

Synthetic identity fraud incurs a lot of damage before it is detected. In this fraudulent approach, fraudsters create false identities using a mix of true and fake information. Using synthetic identities, fraudsters open bank accounts, apply for credit, and make online purchases. No one can trace them until the situation has gotten out of hand completely.

Friendly Fraud

Friendly fraud occurs when an authentic buyer buys something but later on, argues and claims that it was not a fair purchase. Generally, this kind of fraud leads to chargebacks and causes problems for merchants who are dealing with transaction processors.

Strategies for Safeguarding Your Business

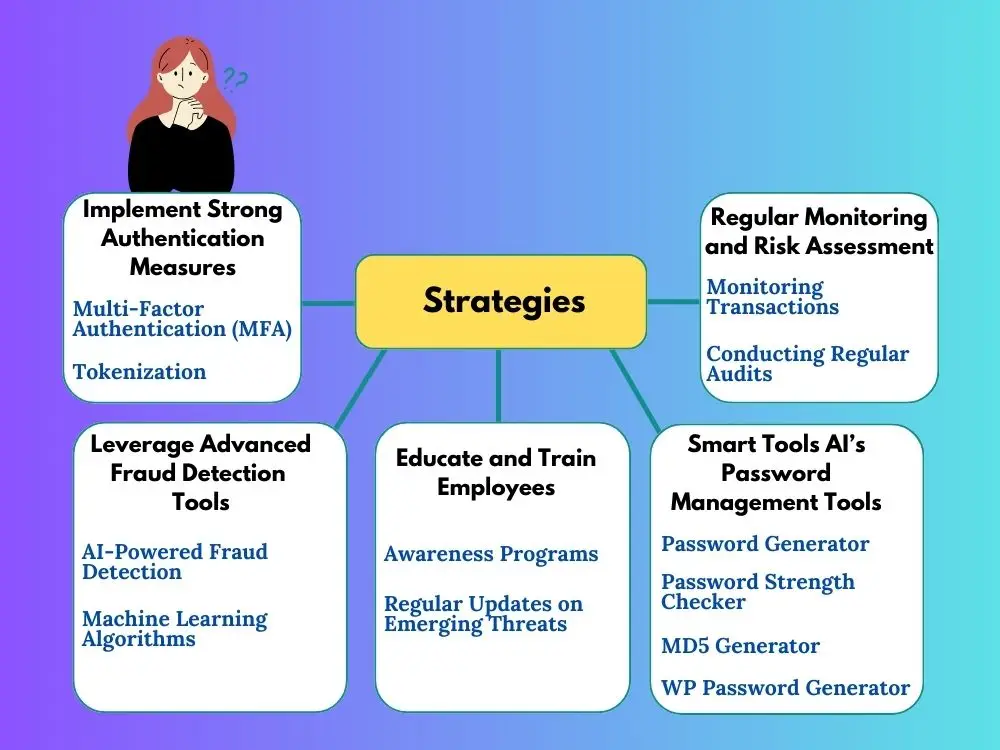

You must protect your business from these emerging threats by implementing robust fraud protection strategies. Let’s see some effective strategies that work:

Implement Strong Authentication Measures

This is one of the most effective ways to protect your business and involves strengthening authentication protocols. It includes the following categories:

- Multi-Factor Authentication (MFA): When you have two or more authentication settings to verify your identity (For example, a secret password and an OTP (one-time password) sent to a phone), it will significantly reduce the risk possibility of fraudsters getting into your account without permission.

- Tokenization: The process involves replacing sensitive payment information with distinct identifiers (tokens) and preserving all the important details while safeguarding them against risks. Tokenization protects cardholder data during transactions.

Regular Monitoring and Risk Assessment

Regular transaction monitoring and periodic risk assessments act as curative measures for identifying potential risks before they cause damage. This includes the following methods:

- Monitoring Transactions Continuously: This enables you to easily detect suspicious activities like huge purchases or money transfers that usually occur from unfamiliar locations. So, when they happen, you can take the necessary steps immediately.

- Conducting Regular Audits: These regular audits allow you to ensure that the security systems meet modern requirements and keep the criminals out as well.

Leverage Advanced Fraud Detection Tools

Technology has a significant role in fraud protection. With advanced tools and software, detecting and preventing fraud can become more efficient.

- AI-Powered Fraud Detection: AI tools are good at examining huge datasets and finding hidden trends or unusual occurrences that might signal fraudulent activities. Each new transaction helps these systems learn or sharpen their predictive abilities, which makes them better every day.

- Machine Learning Algorithms: Machine learning algorithms are good at making accurate predictions of fraudulent activities and help prevent them. Also, they can be configured according to your organization’s specifications and give you a tailored approach towards identifying possible threats.

Educate and Train Employees

You should keep your employees aware of fraud. Therefore, educating and training them on potential threats is essential. This includes:

- Awareness Programs: Periodically conducting courses, workshops, or other awareness programs for your workers will help them become familiar with current fraud techniques and how to detect them.

- Regular Updates on Emerging Threats: Updating and providing adequate information regarding emerging threats to your employees is vital. This is useful for them to respond appropriately and prevent fraud.

Enhancing Security with Smart Tools AI’s Password Management Tools

Employing powerful and secure passwords is one of the easiest but efficient ways to protect your organization from threats. Weak passwords are a regular weak point used by hackers to get to restricted accounts.

Therefore, Smart Tools AI has various password management tools that are helpful for the protection of your business. This includes tools like:

- Password Generator: Come up with complicated and different passwords that hackers will find hard to crack.

- Password Strength Checker: Check how powerful your passwords are, so that they can endure attacks.

- MD5 Generator: Change your passwords into MD5 hash codes, which have secure storage and help in verification.

- WordPress Password Generator: Produce safe passwords destined for WordPress sites to secure both admin and user accounts. Mostly useful for e-commerce sites using WordPress CMS.

With these tools in place, you can minimize unauthorized access and effectively prevent fraud in your company.

Check and utilize Password Management Tools: https://smarttoolsai.com/category/password-management-tools

Integrating Fraud Protection with Compliance Management

Fraud protection is one of the significant components of compliance management. So, ensure that your fraud protection system follows the regulations. This helps your firm in protecting itself and also keeping up with industry standards.

Aligning Fraud Protection with Regulatory Requirements

- PCI DSS Compliance: Known as "The Payment Card Industry Data Security Standard," it serves as a guideline for the protection of credit card transactions. Also, it prevents the occurrence of data breaches and guarantees the safety of payment details. Therefore, you must comply with this regulation to attain safety for your business.

- GDPR and Data Protection: Known as "The General Data Protection Regulation." It requires organizations to secure personal information. Apart from avoiding data leakages, compliance with GDPR is vital for ensuring the safe handling of customer details.

Developing a Comprehensive Fraud Prevention Policy

Developing a comprehensive and accurate fraud prevention policy is necessary for safeguarding your organization against fraud. This should include the following:

- Creating Clear Guidelines: The guidelines should include steps that your company needs to take to avoid, discover, or respond to fraud. It must also provide guidelines on how workers should manage confidential data and report suspicious activities.

- Regular Policy Reviews and Updates: Since fraudsters are changing their tricks all the time, it becomes indispensable to check regularly whether your fraud prevention policy is still valid. This helps ensure that your business remains protected against new threats.

The Role of Technology in Merchant Fraud Protection

Fraud is a serious challenge, and technology is a powerful tool to help eradicate it. By leveraging secure payment gateways and innovative technologies like blockchain, companies can equip themselves with safe measures against fraud.

The Importance of Secure Payment Gateways

- Choosing the Right Payment Gateway: The choice of what payment gateway to go for becomes important when there are fraud issues. Look for gateways that provide encryption, tokenization, and real-time fraud detection.

- Encryption and Data Security: Your transaction data should be protected through encryption. Ensure that your payment gateway uses strong encryption protocols for data protection during transmission.

Utilizing Blockchain for Enhanced Security

Fraud protection can significantly benefit from blockchain technology. Let's see how:

- Advantages of Blockchain in Fraud Prevention: Because of blockchain's decentralized and transparent nature, it is difficult for hackers to manipulate transaction records. Further, the technology assists in minimizing fraud risks across several industries like supply chain management, identity verification, and payment processing.

- Real-Life Examples of Blockchain Working: Different companies have begun incorporating blockchain into their security systems. For example, a payment system based on blockchain platforms is better in security and transparency.

Preparing for the Future: Adapting to New Fraud Trends

As fraud methods keep changing, it’s vital to remain educated and ready for threats ahead. So, following these aspects may help:

Staying Informed on Emerging Threats

- Frequent Learning: You must regularly update your knowledge on the recent fraud trends and strategies. To do this, you can subscribe to industry newsletters, attend webinars, and go to conferences. This will help you stay updated.

- Involving Yourself with Experts in the Field: Interacting with industry specialists in the cybersecurity area can offer worthwhile information about new threats and better ways of counteracting them.

Future-Proofing Your Business

- Implementing Adaptive Security Measures: This means that the security measures must change in response to new threats. Therefore, you may want to consider investing in technologies that can grow with the emerging fraud tactics used by criminals.

- Investing in Continuous Innovation: With this move, companies can stay one step ahead of fraudsters, and it helps protect them from fraud. One way through which they can do this is by embracing new technologies, changing their fraud prevention strategies regularly, and ensuring their workers undergo training on how to prevent hackers from taking over their systems.

Final Thoughts

Merchant fraud protection is an ongoing challenge that requires vigilance, education, and the right tools. Plus, you must protect your business against possible losses and guarantee its survival.

For this purpose, essential knowledge of emerging threats and the constant implementation of effective fraud protection strategies are helpful. Moreover, being current and up-to-date with new threats will become increasingly important for a secure and prosperous business environment as we move into the future of e-commerce.

FAQs

Q1: What should I do if my business gets hit by fraud?

You must report any fraud to your bank or payment provider immediately if it occurs. Also, consider changing your passwords and reviewing recent transactions for suspicious activities. In addition, seek assistance from a fraud specialist who can help fortify security measures.

Q2: How often should I update my fraud protection policies?

Review and update your policies regarding fraud once every year or whenever you alter any aspect of your business such as incorporating new payment alternatives. Such things will assist in safeguarding the business against other recent threats.

Q3: Are advanced fraud detection tools affordable for small businesses?

Yes, many fraud detection tools offer flexible pricing and basic versions that are affordable for small businesses, providing essential protection without breaking the bank.

Q4: How can I make sure my employees follow fraud prevention practices?

Regular training and clear guidelines are key. Keep your team informed and conduct routine checks to ensure everyone is following the right security practices.

Explore Related Posts

https://smarttoolsai.com/post/risk-management-plan-for-your-high-risk-business

.webp)