What is Credit Card Fraud and How Can Businesses Prevent It?

With every swipe, tap, or click of a credit card, businesses have opportunities mixed with vulnerabilities. In fact, running a business is tough enough without worrying about credit card fraud. During each transaction, there is a risk where billions have been lost by businesses to fraudsters who have taken credit card fraud as full-time work.

keeping your business safe from credit card fraud isn't as hard as you think when you follow the right practices. But you need to know what you are up against. Think of it like locking up your store at night. Once you know how thieves operate and what tools work best to stop them, you can protect your business without losing sleep over it.

Key Takeaways

- Understand credit card fraud and its types with examples.

- Learn how credit card fraud affects businesses and the effective ways to prevent it.

- Identify the methods of reporting credit card fraud.

- Learn the common myths in credit card fraud and reality.

- Understand the legal and regulatory considerations and the use of AI tools in preventing fraud.

What is Credit Card Fraud?

Credit card fraud involves the use of someone else's credit card or, more commonly using the vital details from that card without that person's consent. Businesses and individuals use their card details when they operate online where criminals get a chance to steal them. They then go buy things or make transactions using the card or information obtained from it.

Sometimes, it gets even trickier. Thieves might open up a whole new credit card using someone else's or business's name. This is a serious issue where the victim has no clue until they try to get a loan or credit card themselves. This fraudulent attempt can wreck the credit score of the victim significantly.

Credit card fraud is a significant issue where the numbers tell the story. The Federal Trade Commission (FTC) found that Americans lost more than $10 billion to fraud in 2023 and around $33 billion globally.

Types of Credit Card Fraud

| Type | Description | Example |

|---|---|---|

| Card-Not-Present (CNP) Fraud | As the name implies, the fraudster doesn’t need the card to make purchases or transactions. Instead, the fraudulent action is conducted online or by phone without the presence of the owner's card. | Fake orders placed on e-commerce websites by fraudsters using stolen card details. |

| Credit Card Skimming | This is an illegal practice whereby fraudsters install skimmers (small devices) at ATMs or any Point-of-Sale terminals like at a filling station, grocery store, or anywhere else to steal information from cards. | Skimmers at gas stations capture the magnetic strip information of the cardholder. |

| Data Breaches | This is a common attempt by cybercriminals to access and steal sensitive data of businesses and people. | A ransomware attack holding customer data hostage for a fee. |

| Phishing Schemes | These are the fake messages that normally trick victims into revealing confidential information or downloading malware. Most of these come through emails or SMS. | Fake emails that impersonate banks or authorized merchants. They look legitimate and intended to steal the login credentials of the users. |

How Credit Card Fraud Affects Businesses

There can be several ways businesses get impacted when there is a credit card fraud occurs. The most common and immediate impact is the financial losses. Apart from this, businesses lose their reputation and consequently lose customer trust. As per cybers security ventures’ guide “Research also shows that up to 60% of small businesses may close within six months following a fraudulent attack”.

Further, once the business loses its customer trust it will be tough to gain it back. Businesses are also likely to face higher security costs and compliance challenges after a data breach. This turns the entire business into an unsustainable one.

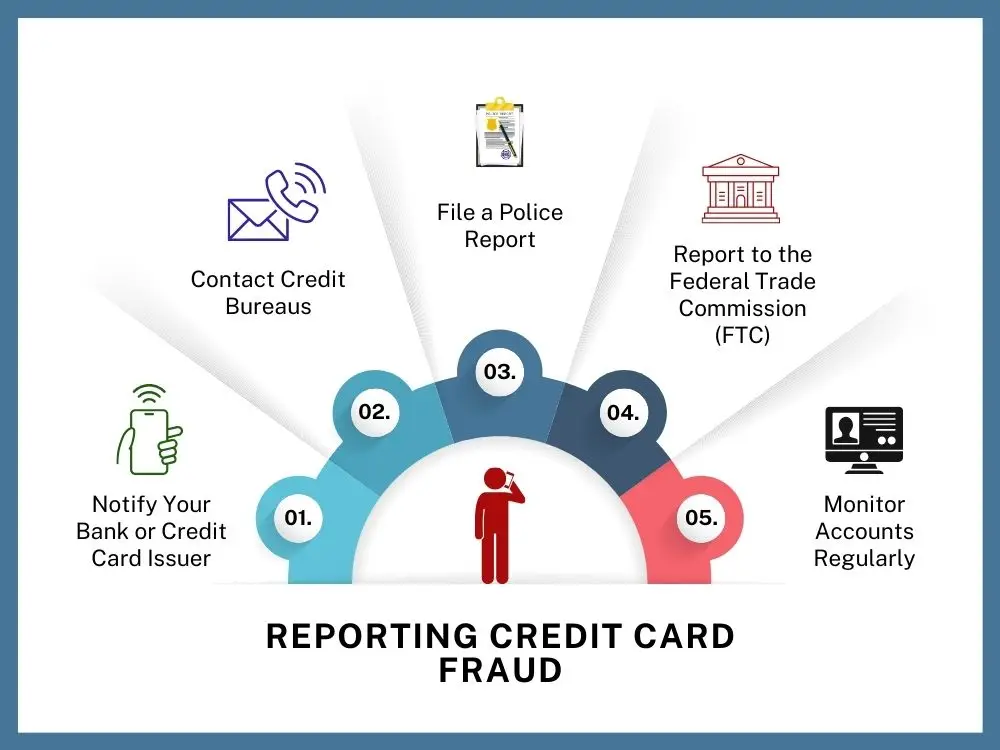

Reporting Credit Card Fraud

Reporting the fraud is significant and must be done on time as soon as you encounter the fraud. Businesses and individuals must act quickly to minimize unnecessary damages and obtain the chance of recovering lost funds. Let's figure out a step-by-step guide to reporting credit card fraud:

- Notify Your Bank or Credit Card Issuer: If you see any unauthorized charges on your card or anything suspicious, quickly call your card issuer and tell them all the necessary information about the suspicious fraudulent transaction(s). You can use the 24/7 hotline (most banks do have it).

- Contact Credit Bureaus: This step is important where you need to inform major credit bureaus like Experian, Equifax, and Transunion. Inform them to make a fraud alert on your credit report.

- File a Police Report: It’s not necessary to file a police report. However, this could help you catch thieves or make insurance claims.

- Report to the Federal Trade Commission (FTC): If you are or your business in the US, you can report the credit card fraud to FTC. You can utilize their online portal or helpline for reporting. Additionally, businesses experiencing losses can notify local consumer protection agencies.

- Monitor Accounts Regularly: After a fraud, you should diligently pay attention to all your accounts. It will protect you from any future fraudulent attempts and losses.

Common Myths About Credit Card Fraud

The misconception about credit card fraud prevents businesses from taking proper steps to protect them. The table below breakdowns the common myths and the realities behind them:

| Myths | Reality |

|---|---|

| Fraudsters only target large businesses | Cybercriminals target both large and small businesses. In fact, the statistics show that 43% of fraudulent attacks are targeting small businesses because of their inefficient security measures. |

| Chip cards are the safest things available | Chip cards can be relevant to protect from card present fraud. However, card not present (CNP) fraud requires only the information on the card where chip cards can't be secure in this case. |

| It's easy to identify a fraudulent transaction | Most fraudulent transactions look like legitimate ones. It's somehow hard to figure out them without AI-powered tools or advanced analytics. |

| Payment systems don’t need strong passwords | The root cause of data breaches and criminal transactions is weak passwords which serve as an entry point for fraudsters. |

It's essential to know and address these myths to prevent your business from any fraudulent acts. Don't let the cybercriminals take advantage by believing in the common myths.

Effective Ways to Prevent Credit Card Fraud

Every business requires strong security measures because the risk of credit fraud continuously increases. Companies should include necessary protection measures in their business plans. The good news is that there are multiple ways to reduce the risk of falling victim to fraud. Let’s see some effective methods:

- Advanced Security Measures: Invest in advanced security measures that use encryption and multi-factor authentication for all users. Ensure all of your systems are PCI DSS compliant and only make transactions or transfer funds using secure payment gateways. Some companies also find that setting up fake phone numbers helps reduce the risk of fraud in high-risk niches.

- AI Fraud Detection Tools: These tools use behavioral analytics to quickly spot anomalies or risks before the fraudsters have the chance to compromise your data.

- Employee Training: You have to train and educate your employees to recognize phishing attempts, suspicious transactions, malware, or other cybersecurity threats. Regular workshops and updates help employees stay informed about evolving fraud tactics.

- Strengthen Customer Verification Processes: This method mandates strong authentication methods like OTPs (one-time passwords) or biometric verification for sensitive transactions. Use tools like address verification (AVS) and CVV checks during online transactions.

- Actively Monitor Transactions and Set Limits: By establishing transaction monitoring systems, you can flag unusual activities such as high-value or rapid-fire transactions. Set spending and frequency limits for card use to minimize potential losses from fraud.

Legal and Regulatory Considerations

Let's talk about the legal side of protecting against credit card fraud. Here's what every business needs to know:

- PCI DSS Compliance: This is an essential rule to follow. Think of it as your security baseline, you need proper encryption and secure systems to protect customer card details.

- GDPR and Data Protection: If your business has customers in Europe then GDPR is a vital regulation to follow. This regulation takes data privacy very seriously. if you mess this up, you're looking at massive fines. They want to know exactly how you're handling customer's personal info.

- CCPA in California: California has its own rulebook called CCPA. According to this regulation, you’ve got to be straight with customers about how you're using their data.

- Anti-Fraud Laws: These laws help effectively address payment fraud. For example, the US Computer Fraud and Abuse Act (CFAA). Breaking these laws is bad for businesses and could put you in legal trouble. Sticking with the rules is always better from the beginning.

How Smart Tools AI Helps Businesses in Credit Card Fraud Prevention

AI tools help transform the way businesses fight credit card fraud. They provide advanced, data-driven solutions. At Smart Tools AI, we offer some tools that businesses can use to safeguard their operations effectively:

Credit Card Generator

The Credit Card Generator is an essential tool for businesses developing or testing secure payment systems. This tool allows developers to:

- Simulate Transactions: Generate realistic, fake credit card numbers to test payment platforms without using real customer data. For example, an e-commerce business can simulate high transaction volumes during checkout testing to ensure the payment gateway works smoothly and identifies any errors.

Password Management Tools

Strong passwords are important to defend against unauthorized access and data breaches. Our Password Management Tools help businesses:

- Generate Secure Passwords and check their strength: Using our tools, you can generate passwords that hackers find difficult to break and check the strength of your passwords to keep the security in place. For instance, a SaaS company uses this tool within its platform and guides its users to set up strong, automatically created passwords for their accounts.

- Encourage Best Practices: Provide customers and employees with secure password solutions to minimize risks. For example, a financial institution utilizes the tool to enforce strong password policies for its staff and educate customers about creating secure logins.

In addition to these tools, for businesses testing secure payment systems or fraud detection mechanisms, our Fake Name, phone number, and Address Generators can be invaluable. They provide realistic but fictitious personal information that you can use to simulate customer profiles during testing.

For example, these tools allow developers to create mock customer accounts and transactions without exposing real data. This ensures privacy and security during development and quality assurance processes.

Wrapping Up

Protecting your business from credit card fraud is absolutely important. By understanding the types of fraud, implementing effective prevention strategies, and leveraging advanced tools of Smart Tools AI, you can effectively safeguard your businesses and their operations. This will help you ensure customer trust and sustain longer in the market. Stay proactive and keep fraudsters away.

FAQs

Q1: What is the biggest credit card fraud in history?

The 2013 New Jersey case where Tahir Lodhi and 18 others stole $200 million using fake identities and credit profiles. They got caught after running the scam for a decade.

Q2: How can I detect credit card fraud?

Watch for unusual spending patterns, multiple declined transactions, and mismatched billing info. You can also use fraud detection tools to figure out fraudulent acts. Always watch out for orders from suspicious IP addresses.

Q3: What should I do if my business experiences a data breach?

First, shut down affected systems. Then notify your bank, affected customers, and relevant authorities within 72 hours. Document everything and get your cybersecurity team on it ASAP.

Explore Related Posts

https://smarttoolsai.com/post/osint-framework-for-businesses

https://smarttoolsai.com/post/risk-management-plan-for-your-high-risk-business

.webp)