Shaping the Future of Finance: How AI is Revolutionizing the Industry

How about a person who does all your work, and you relax with minimal supervision or involvement? Sounds pretty good, right? This is what artificial intelligence (AI) does, and it is a machine that can act like a human and streamline your work.

It retrieves data from machine learning and simplifies the work. In simple words, AI is known as machines or systems that think, act, or function like humans, which helps in completing work easily within a minimum timeframe.

AI can be efficient, but at the same time, it has some drawbacks. But when we weigh down these two things, the benefits are higher than the pitfalls, and completing daily tasks has become so convenient with the advanced technology used in artificial intelligence.

Many industries have been utilizing the power of AI in their daily tasks, and it has the maximum potential to revolutionize the finance industry, too.

Key Takeaways

- Understand how AI automates tasks by acting like a human, streamlining work, and retrieving data through machine learning.

- Explore AI's role in banking through chatbots, fraud detection, and automation, enhancing customer interactions and operational efficiency.

- Learn about AI's benefits and drawbacks, with a focus on its higher benefits in various industries, particularly in finance.

- Discover the importance of merging AI with the finance industry to manage business effectively, reduce financial risks, and improve customer service.

- Recognize AI's potential in investments and risk management, providing personalized portfolios, predictive analytics, and mitigating financial risks.

The Finance Industry

Finance is a huge industry that encompasses various sectors such as banking, financial companies, real estate brokers, Insurance companies, Mortgage firms, the Stock market, Trading, and many others.

The finance industries mainly focus on serving its clients to stabilize and maximize their financial capability. Also, they are influenced by many factors that are known as inflation, interest rates, government rules and regulations, economic conditions, market volatility, and many more.

Managing these factors is an important function for industries to sustain and provide the best customer experience. Every finance industry focuses on managing its business to provide the best financial services. This will help them make their client happy by managing the fluctuating factors.

Importance of Merging AI with the Finance Industry

Merging the AI and finance industries is essential in today’s business environment. AI integration in financial sectors offers many benefits. Plus, AI technology helps manage the finance business effectively and reduces financial risks.

AI technology can be very effective in identifying investment opportunities, improving fraud detection, improving customer experience by automating services, enhancing regulatory compliance, and controlling operational costs.

Moreover, AI simplifies the work of the financial sector, where there are minimal requirements for employees to work on customer-centric tasks. By considering all of these benefits, integrating AI in the finance industry is viewed as an invaluable thing.

Now let's understand how AI is helpful in different financial sectors:

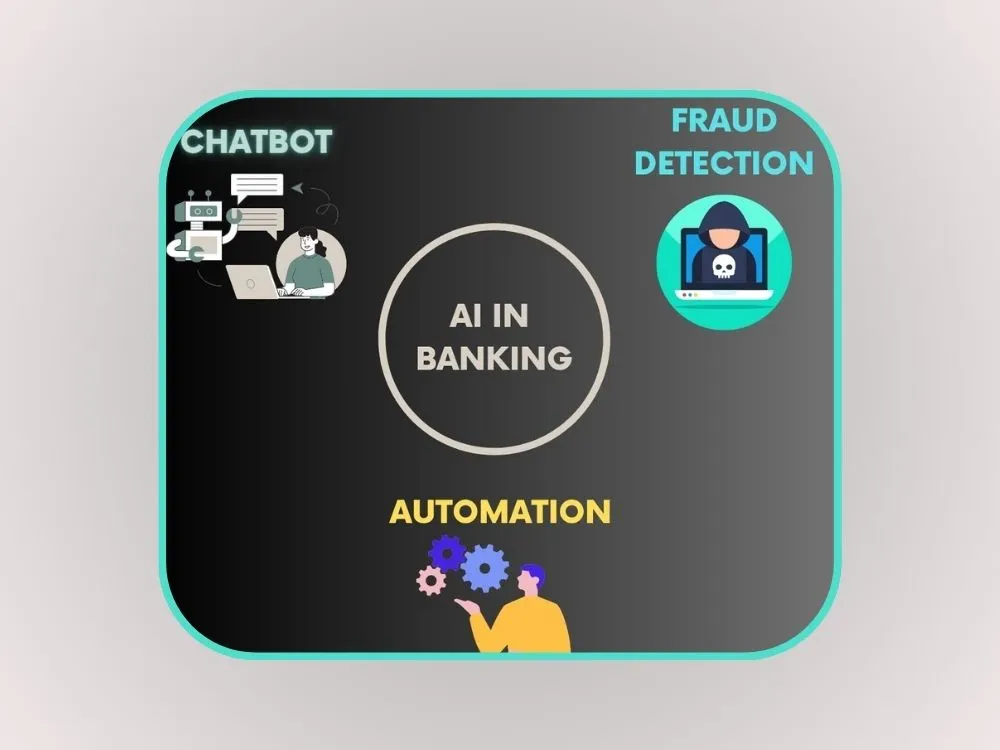

01. AI in Banking

A) Chatbots

A chatbot is a software program that uses artificial intelligence (AI) and natural language processing (NLP) to automatically respond to customer inquiries. Nowadays, chatbots are used by the banking sector as they help improve customer experience by streamlining customer interactions.

It also provides important details such as bank balance statements, transaction records, interest rates, and personal finance advice. Additionally, it assists in making money transfers, bill payments, and many other services.

Using a chatbot can automate these vital tasks of the banking industry, where the banking staff can focus on other necessary duties and improve the convenience of the customers. These AI-powered chatbots can learn from previous interactions and thereby they can provide on-time, efficient data without major errors.

B) Fraud Detection

AI-powered fraud detection has become an important thing. It helps identify fraudulent acts, such as fraudulent transactions and suspicious patterns in a bank. It can function as an efficient tool to protect the data of the customers.

Utilizing advanced technology and machine learning, AI can very easily identify any fraudulent or suspicious activity. This helps prevent those activities from occurring. Also, by utilizing this AI-powered fraud detection, banks can mitigate many fraudulent acts, such as credit card fraud.

Therefore, integrating AI-powered fraud detection in banking sectors helps banks stay one step ahead of fraudsters and provide a safe banking experience to their valuable customers.

C) Automation

Automation in the banking industry utilizes AI technology. It has the potential to change traditional banking processes into more advanced ones. Moreover, it also improves the customer experience. Automating the systems is more useful for quick and accurate banking services than doing it manually.

Banks can automate various banking processes like fraud detection, compliance checks, customer chatbots, and many more that can reduce errors and save time. One other benefit of automating the processes is that it can serve 24/7, and customers can access the service whenever they need it.

Leveraging advanced AI technology to automate processes can improve the analysis and interpretation of customers’ data and help banks enhance productivity.

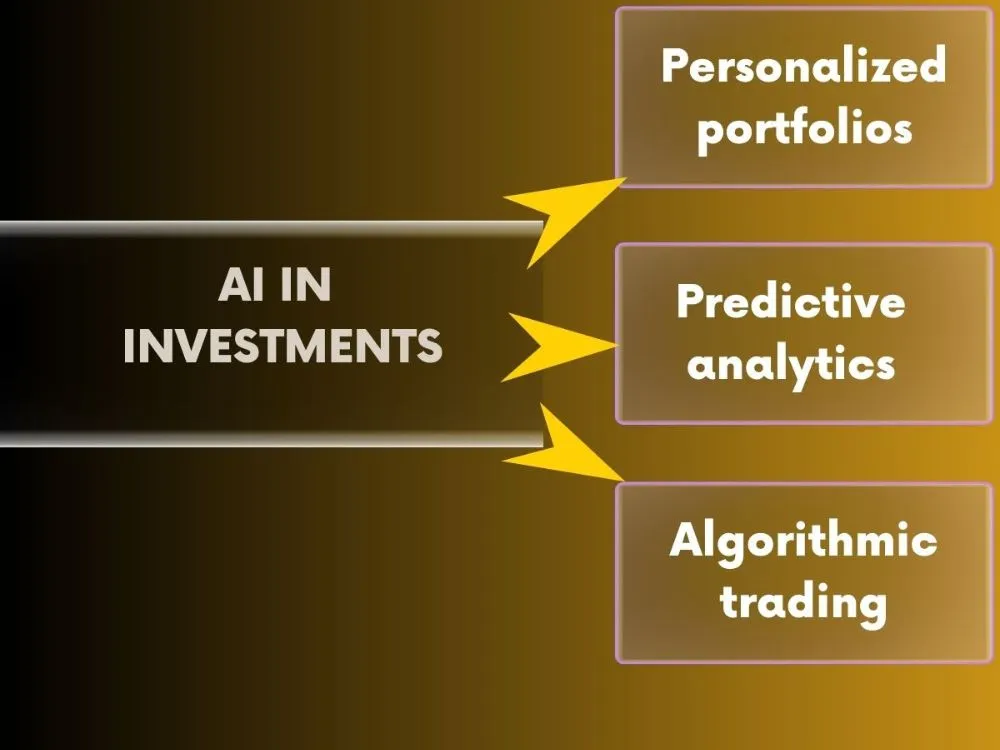

02. AI in Investments

A) Personalized Portfolios

Artificial Intelligence (AI) is changing the landscape of investment by presenting sophisticated algorithms and machine learning models. This advancement facilitates the creation of personalized portfolios that align with the specific investment requirements of each client.

Investors can benefit from a custom-built portfolio rather than opting for a generic portfolio that can be tailored to their individual investment goals and risk tolerance. Through AI technology, vast data analysis is possible, and it can uncover patterns that may evade human observation.

As a result of this, investors gain access to a more specific investment strategy, which increases the possibility of gaining superior returns. With further improvements, AI-driven personalized portfolios are expected to gain favor among investors, especially those who are seeking optimal returns with minimal risk.

B) Predictive Analytics

Predicting the necessary data is vital when making investment decisions. Using AI, making these important predictions can be easy and help make informed investment decisions. Predictive analytics can analyze a vast amount of data from various sources with the help of advanced AI technology. This helps find out investment trends and patterns.

Also, generating future market predictions is convenient using this tool. Therefore, investors can understand the necessity of predictive analytics with the help of AI to find potential risks, market behaviors, trends, patterns, and many other factors.

Moreover, predictive analytics is useful for making decisions regarding investment plans in a particular matter and ensures maximum returns for the investments.

C) Algorithmic Trading

Algorithmic trading is also known as algo trading or black box trading, which is a significant application in finance. It assists in automating the trading processes using computerized pre-programmed trading instructions.

These algorithms can effectively analyze extensive amounts of financial data and complete trades based on their results. The integration of AI in algorithmic trading can result in significant enhancements in the speed of trade execution, accuracy, and efficiency.

Moreover, AI Trader enables finance companies to capitalize on real-time market opportunities, reduce human errors, and enhance the outcomes of trades. As the financial industry evolves into more intricate forms, AI-powered algorithmic trading can emerge as an essential tool for investors.

03. AI in Risk Management

A) Scenario Analysis

Scenario analysis in risk management can be defined as an examination of possible risk outcomes based on many factors. Integrating AI in the process of scenario analysis aids companies one step closer to the future of predicting upcoming risks and effectively mitigating them.

Scenario analysis entails making hypothetical situations where it is based on historical data to assess the potential impacts of a specific business decision on company operations. By integrating AI into this process, businesses can simplify scenario analysis and minimize the risk of wrong predictions.

AI can analyze large volumes of data in real time, recognize patterns and trends, and deliver insights into how the business can react to certain circumstances. As a result of this, AI empowers businesses to make well-informed decisions and mitigate risks effectively.

B) Credit Scoring

The finance industry has experienced significant gains with AI emerging as a transformative force. With the help of AI, financial institutions can able to streamline operations, mitigate risk, and identify potential losses. Credit scoring stands out as a renowned application of AI in finance.

By analyzing vast datasets, AI is employed to evaluate credit risk and identify certain patterns that may predict a borrower's likelihood of loan default. AI algorithms can easily gather information about borrowers' financial status and repayment history to generate a score that helps lenders in their decision-making process.

By allowing a data-driven approach to lending, AI can empower banks and financial institutions to make informed decisions, lower risk, and ultimately improve the well-being of their customers.

C) Models for Predicting Economic Fluctuations

These models are becoming more popular among financial sectors. Machine learning algorithms are used to forecast the behavior of financial markets. This helps detect irregular patterns and warn traders immediately.

These predictive models help manage the risk associated with economic fluctuations and identify the optimum time for investment. AI is efficient where financial sectors can easily assess market conditions and make informed decisions that drastically decrease the impact of risk.

Also, AI technology is continuously evolving, and that provides risk management systems with more accuracy, fast, and reliability in anticipating changes in the economy.

04. AI in Customer Service

A) Enhanced Customer Experiences

The capabilities of artificial intelligence (AI) are becoming more popular in the customer service industry. AI can transform the way that businesses engage with their valuable customers by delivering seamless experiences.

Using AI in customer service enables companies to provide 24/7 service. Plus, with the support of AI chatbots, customers get quick answers to their important queries. Further, AI-powered systems can analyze customer data, predict common problems, and deliver certain solutions that improve customer satisfaction and commitment toward the company brand.

By leveraging the power of AI, customer service teams can concentrate on more complex queries, and customers receive timely and useful solutions to all of their needs.

B) Increased Customer Satisfaction

Through the integration of AI, businesses get several benefits, where AI helps perform customer service effectively. This remarkable advancement has greatly elevated customer satisfaction levels. According to research, customers highly value rapid responses, valid information, and personalized communication.

AI technology allows businesses to analyze the behavior and preferences of customers, which empowers them to offer promotions and discounts matching individual interests. As a result of this, the integration of AI in customer service positively enhances customers' overall satisfaction and increases business profitability and growth.

C) Predictive Analytics

Predictive analytics is an emerging technology that harnesses the power of AI. It utilizes AI to determine various patterns and trends that enable data-driven forecasts about customer behavior and facilitate a more personalized brand experience.

Predictive analytics includes a wide range of applications that can reduce customer churn, enhance the customer experience, and optimize sales and marketing efforts. It also powers automated chatbots that offer personalized product recommendations based on customer history and behavior. This enables real-time decision-making and action.

Therefore, businesses that include predictive analytics in their customer service strategy gain a competitive advantage over their peers.

The Ethical Implications of AI in The Finance Industry

A) Inequality

The ethical implications covering AI in finance are becoming increasingly complicated, with a particular focus on the potential for worsening inequality. AI can reflect and memorialize historical patterns of discrimination, thus amplifying existing inequalities.

An example of this is observed in AI algorithms, which might show bias towards loan applicants based on race or socioeconomic status. This may lead to an unfair marginalization of certain individuals or groups.

It's also important for finance sectors to carefully address the ethical implications of AI and ensure that the technology is utilized in a manner that encourages fairness and equality, rather than contributing to increased inequality.

B) Job Loss

By leveraging the powers of artificial intelligence (AI), the finance industry obtains numerous benefits. This includes things like improved fraud detection and enhanced decision-making capabilities. Regardless of the benefits, some ethical concerns have also emerged, particularly regarding job loss.

According to the World Economic Forum's report, AI and robotics are estimated to replace over five million jobs in the finance sector. There will be significant consequences with the potential of huge job losses.

This raises important questions about the necessary responsibilities of financial sectors towards their employees, as well as the effect on the economy and society. As AI continues to rise, it's vital to consider ethical implications and make sure of a fair and equitable change in this new technological landscape.

C) Bias

AI integration in financial systems carries ethical implications, particularly concerning the potential bias of AI systems. These systems depend on historical data and can be biased against specific groups.

AI systems may unintentionally perpetuate or amplify biases present in the training data that lead to discriminatory outcomes. To address this, it's vital to establish ethical frameworks, guidelines, and bias detection tools to mitigate the risks associated with AI in finance.

This includes critically evaluating the accuracy of historical data inputs and enabling diverse datasets to promote fair and unbiased future financial outcomes.

The Future of Finance with AI

A) Increased Efficiency

The future of finance with AI technology integration holds immense promise, particularly in terms of increased efficiency. AI-powered algorithms enable performing real-time finance-related tasks such as account reconciliation, financial statement analysis, and fraud detection that eliminate the requirement for human intervention.

This leads to significant time savings for financial institutions and enables them to prioritize other essential parts of their operations. The enhanced efficiency facilitated by AI allows industries to optimize decision-making processes, conserve resources, and deliver good customer service.

B) Increased Accuracy

AI is already showing a notable benefit in financial management and decision-making through increased accuracy. By analyzing vast volumes of data and swiftly finding out the trends and patterns, AI helps eliminate inaccuracy.

Also, AI supports the risk mitigation process and improves financial outcomes with exceptional accuracy. This will empower financial sectors to make well-informed decisions and work quickly. This leads to good results for customers and investors.

As AI progresses and grows more sophisticated, we expect to witness even more remarkable advancements in accuracy and precision within the financial sector.

Wrapping Up

This article covers the important factors of Artificial Intelligence (AI) in various finance sectors. It discusses the significance of AI, explaining its capabilities and potential. The article highlights the importance of merging AI with the finance industry and emphasizes the transformative power it holds.

It also explores the ways AI is reshaping finance, including its application in banking, investments, risk management, and customer service. Further, it addresses the ethical implications that derive from integrating AI in the finance industry, which encourages a thoughtful approach towards responsible implementation.

Finally, it discusses the future of finance with AI, shaping a vision of a more efficient, data-driven, and customer-centric industry.

FAQs

Q1: What exactly does AI mean?

AI stands for Artificial Intelligence. It refers to machines or systems that can think, act, or function like humans, which makes human tasks easier and more efficient.

Q2: What does an AI do?

Generally, AI performs multiple tasks by processing the data, learning from it, and making decisions. It facilitates work procedures, identifies patterns, and even acts like a virtual assistant.

Q3: How can I use AI?

It depends. You can use AI in various ways. It can be AI-powered apps on your phone or a web-based SaaS that helps business processes. For personal use, AI can help with tasks like voice assistants, recommendations, and several others, while from a business perspective, it helps automate and simplify work and save time.

Q4: How is AI used in finance?

AI is used in finance to enhance efficiency and reduce risk. It's employed in several areas like chatbots for customer service, fraud detection, automating tasks, personalized investment portfolios, and predictive analytics.

Q5: What is the future of AI in the finance industry?

The future of AI in the finance industry can be promising for enhanced efficiency and accuracy. AI will continue to play a critical role in automating tasks, making data-driven decisions, and enhancing customer experiences.

.webp)