How to Write a Follow-up Email to a Client for Payment?

Ever thought why your client hasn't responded to your payment request? Clients are unresponsive for various reasons. This includes being occupied with work or simply not seeing your email because it may have ended up in their spam folder. Even though it may feel weird, writing a follow-up email is one of the essential aspects of running your business.

Your clients hired you because they trust your work, so please don't take the non-response personally. A delicately written follow-up email works well towards accomplishing the agreed terms while upholding the professional relationship, with payments done on time. This detailed guide will help you structure a perfect follow-up email to send payment reminders.

Key Takeaways

- Learn how to write follow-up emails for client payments without damaging relationships.

- Use a proven downloadable email template that you can customize for any situation.

Create a Valuable Subject Line

The email subject needs a bit more nurturing than the body text. This is because it grabs the attention of the recipient, and simultaneously affects whether the email will be read or dropped into the trash. Keep the subject line clear with at least the due date and invoice number. In this way, it will ensure the recipient never misses it amidst all the other emails.

Moreover, include the due date in the first email, along with a quick reminder about how long until a late payment can be made. Follow this with your polite yet professional tone in reminders. You should put the number of business days late in the subject line for overdue invoice reminders to grab attention.

Personalize The Greeting

Start with a greeting when you send a reminder (follow-up) email to your client. This is vital to maintain a friendly tone. See the example below:

"Hi [Recipient's Name], I hope you're doing better and that your new product launch is going smoothly." You can also start with a Dear or Hey. This greeting works because it:

- Uses the client's actual name instead of generic terms.

- Shows genuine interest in their current projects or situation.

- Creates a good, personal connection before discussing business aspects.

- Sets a friendly tone that makes the payment request feel less transactional.

The key is referencing something specific about their business or recent conversations you've had. This means you see them as more than just a paycheck, and it helps maintain the relationship while addressing the payment matter.

Reference The Previous Email

You have to add a context reference after the personalized greeting. This could be in the form of when you last conversed. For example, "Regarding the phone call we had last week, we discussed [topic]." If it was through email, you can say, "Do you remember when we swapped emails in the past regarding [topic]?"

It's all about summing it up in 1-2 sentences about what you discussed. It will make them remember you and why you are following up with them again. Don't assume they will remember each and every meeting or information they had with you before.

Determine The Objective & Communicate It

You have already talked to your prospect and exchanged information. Now it's time for you to send out a reminder. Before you write your follow-up email. Here, you must be clear about your objectives and specific goals. Your second email should clearly communicate your goals in order to eliminate any misunderstanding.

This will make the prospect think you are worth their time and will therefore respond sooner. Your ultimate goal here is to receive payment back from them. So, be friendly and respectful towards them. This will or won't occur in one email. However, it's all about systematic and patient follow-ups.

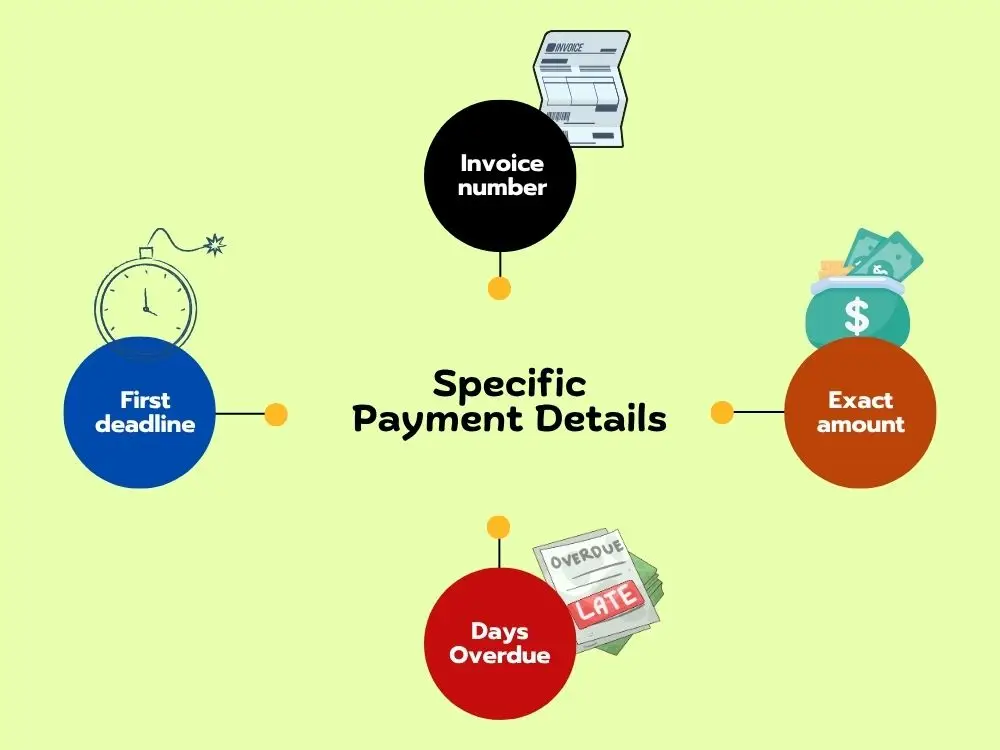

Be Specific About Payment Details

It's important to avoid your client guessing about the amount they owe or the due date. Provide all required information to simplify the payment processing as soon as possible. Your details should clearly state:

- Invoice number: Invoice #12345

- Exact amount: $10,000

- First deadline: Due on October 15th

- Days Overdue: Already 10 days past due

This level of information serves two main purposes. It helps the client identify the document in their system without having to search across several files or emails. It also shows that your methodology follows correct, organized practices appropriate for this field.

You can add this information naturally within your email, like "I'm following up on Invoice #12345 for $10,000, which was due on March 15th and is now 10 days overdue."

By providing specific details, you can easily mitigate uncertainty and achieve a timely response from the client. It also demonstrates caution in documentation practices, thus ensuring timely payment in future projects.

Strengthen your value

You should avoid generic or lazy follow-ups that only serve as a simple check-in. This is because these kinds of emails have no value and your recipient might feel them as unnecessary. If you add value, the recipient might consider it worth their time to open or respond to your email.

These follow-up offers could be

- A valuable gift (A tangible or digital gift)

- A webinar invitation

- An E-book or how-to guide/video

- An exclusive discount or offer

Whatever you choose, make sure that it's relevant and valuable to the recipient.

Keep Your Message Short but Friendly

Keep in mind that everyone has a packed routine. The same is the case for your clients. They may have unintentionally forgotten or had thought to pay but got busy. You have to be kind in your first payment reminder message.

The goal of a follow-up email isn't to sell your client all over again. It's simply a reminder. Since most people skim long emails, which keep messages short and to the point, while covering the key details.

Moreover, summarize your emails to maintain a better, professional tone. It's easier to express your idea without overloading the reader with a straightforward message.

Give Them Directions about Paying

Not all clients get benefits and miss payments because they want to take advantage of you. Some wind up in emergencies or with unexpected financial troubles. Others may find it difficult to pay you simply because they can't use your preferred payment methods. So, provide a clear direction for them to pay.

Make sure your clients know how to make online payments when you use digital invoices. Provide them with a simple, step-by-step guide to prevent misunderstandings. Also, avoid billing your clients unexpected late fees. In each payment reminder email, clearly mention if you add any additional fees in case of a fine or late payment, such as:

- 1 week late: [Fee amount]

- 2 weeks late: [Increased fee amount]

This will ensure transparency and encourage timely payments.

An Example of a Follow-up Email Template

Wrapping Up

You may expect your clients to make their payments on time. Unfortunately, that's not always the case. Still, a late payment doesn't mean a nonpayment. Sending a payment reminder email helps you get paid what you're owed. Use these proactive tips to create follow-up emails to improve your business cash flow, and learn when and how to send them to get your cashback from your client.

FAQs

Q1: When should I send my first follow-up email?

You can send it after 3-5 days of the payment due date. This gives clients a grace period while showing you're organized. Tuesday through Thursday, between 10 AM - 2 PM works best for response rates.

Q2: How many follow-up emails should I send?

Send 2-3 follow-up emails at a one-week interval. Begin by being pleasant, then be more direct. Think about using other collection techniques or calling after three unanswered emails.

.webp)