.webp)

A Complete Guide to KYB (Know Your Business): Regulations, Processes, and Best Practices

Have you ever thought about how big companies make safe business decisions every time? As organizations expand their operations and partnerships, the risks of fraud and financial losses have become increasingly concerning.

This is where KYB or Know Your Business comes in. It's a practical solution that helps firms go ahead and verify the validity of their business connections. Consider it as a thorough background check that would spare your company from costly pitfalls.

In this guide, you'll get to know how KYB helps you make informed decisions while keeping things straightforward and compliant with regulations.

Key Takeaways

- Learn how Know Your Business (KYB) verifies business legitimacy and prevents fraud.

- Discover key compliance laws (AMLD, BSA, FATF) and the steps involved in KYB verification.

- See how KYB enhances security while overcoming regulatory complexities and fraud risks.

- Leverage AI Tools for KYB. Find out how Smart Tools AI helps streamline verification.

What is Know Your Business (KYB)?

KYB is an effective way to know who exactly you do business with. You wouldn't just give your money to some random stranger on the street, right? That's the same way it should apply to business partnerships. Here, KYB helps you verify that a company is legitimate before you even start doing business with them.

It's not just paperwork but it's about protecting your business from fraud and partnerships that could get you into trouble. The process uses automated checks to spot potential red flags like fake companies or those involved in suspicious activities.

While it's required by law, think of KYB as your business's security guard that helps you make smarter and safer decisions about who to work with.

Legal and Regulatory Framework

Various regulatory bodies enforce KYB compliance regulations. This is to ensure preventive measures against financial crimes worldwide. For every country, there will be a different set of rules for KYB which businesses must comply with. Some of the important regulations are:

- Anti-Money Laundering Directives (AMLD, EU): This law requires firms to verify their corporate customers and UBOs (Ultimate Beneficial Owners).

- Bank Secrecy Act (BSA, US): This regulation needs financial institutions to monitor and report suspicious activities.

- Financial Action Task Force (FATF): This one set global KYB standards for financial transparency.

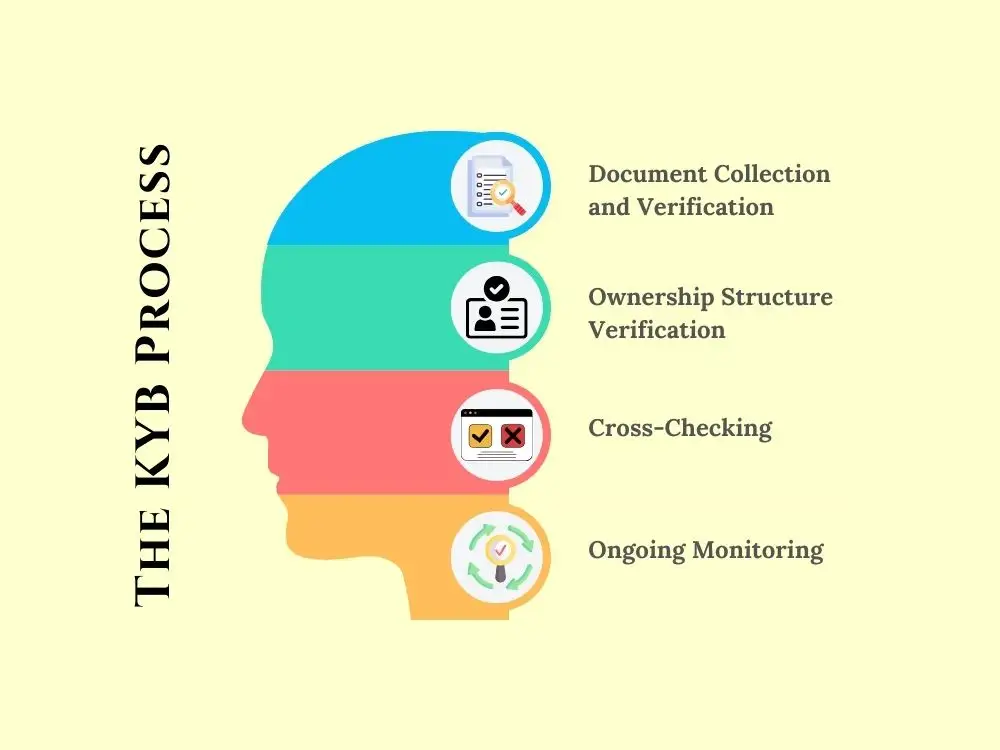

The KYB Process

KYb isn't a one-step process, it involves multiple stages which offers a thorough screening of corporations before onboarding them. The KYB process involves the following major steps in its operations.

01. Document Collection and Verification

Companies deal with other entities across borders and onboard them for various purposes. This could be anything like partnerships, investments, or simply obtaining their services. So, firms provide online portals to submit various documents that are necessary to collect for verification.

These documents may involve company registration papers, financial statements, and UBO lists. In the KYB process, the first step is document collection & screening to find authenticity. KYB services utilize optical character recognition (OCR) technology to fetch data from images and convert it into text format. Businesses can utilize our JPG to Word or Image to Text converter for this purpose.

It offers a streamlined process for thorough screening of documents to find their authenticity. Many fraudsters utilize fake and forged papers which are difficult to identify without an up-to-date verification process such as KYB.

02. Ownership Structure Verification

The KYB process has a critical step related to identifying and verifying Ultimate Beneficial Owners (UBO). A substantial part of the activity involves verifying whether the beneficial owners of a company are genuine and not engaging in illegal activities. As part of this process, KYB services incorporate UBO verification to enhance organizational security by identifying high-risk UBOs.

This verification process improves transparency in business ownership structures which helps companies protect themselves from fraud and criminal activities. The process utilizes advanced, automated algorithms to verify entities and screen UBOs. This ensures enhanced security and the smooth operation of organizations.

03. Cross-Checking

The KYB process also utilizes pre-trained algorithms to perform automated checks. This ensures a streamlined cross-matching process. An organization's information is verified against various records and databases to ensure accuracy and regulatory compliance.

Additionally, company representatives' IDs are screened against watchlists and sanctions to identify any potential risks. This is a fast and efficient process, leveraging artificial intelligence to provide quick and accurate screening within the KYB framework.

04. Ongoing Monitoring

The process also involves a step to offer ongoing monitoring services where companies can detect the changing behavior of organizations after onboarding. In partnerships and investments, it's important to consider and identify the risk potential of all the representatives and people involved.

The KYB checks not only offer a one-time verification process but also involve an ongoing monitoring process to detect the changing behavior of entities.

Benefits of KYB

Implementing a robust KYB process provides several advantages beyond regulatory compliance. It also creates an environment where businesses build trust and reduce risk. Examples of benefits include:

- Fraud Prevention: Identifies and stops fraudulent entities before actually dealing with them.

- Regulatory Compliance: Ensures the business meets necessary legal obligations and avoids penalties imposed by law.

- Reputation Protection: Enhance credibility and foster secure partnerships.

- Operational Efficiency: Streamlining verification processes that reduce manual work.

- Risk Management: Assess and mitigate high-risk entity exposures.

Challenges and Limitations of KYB

Despite its advantages, KYB also comes with challenges that businesses must navigate for effective implementation. These challenges include:

- Complex Regulatory Requirements: Different jurisdictions have varying compliance laws that make global KYB difficult.

- Data Accessibility: The lack or inconsistency in accessing corporate data can be a stumble in verification.

- False Positives: Automated checks may flag legitimate businesses incorrectly and cause delays.

- Cost and Resources: Implementation of KYB solutions has a price and requires resources.

- Evolving Fraud Tactics: Fraudsters continuously look for new possibilities to bypass KYB measures.

To overcome these challenges, businesses should adopt advanced technology and ensure their KYB strategies align well with evolving compliance standards.

The Difference Between KYB and KYC

KYC aka "Know Your Customer" is for individual customer verification while KYB is for companies. Let's find out the common differences:

| Feature | KYB (Know Your Business) | KYC (Know Your Customer) |

|---|---|---|

| Purpose | Verifies businesses and their legitimacy | Verifies individual customers |

| Who It Applies To | Companies, suppliers, vendors, and partners | Individual customers or clients |

| Verification Process | Checks business registration, UBOs, financial records | Confirms personal identity (ID, address, background) |

| Regulatory Focus | Anti-money laundering (AML), business transparency | AML, fraud prevention, customer due diligence |

| Key Documents | Business licenses, financial statements, UBO lists | Government-issued ID, proof of address |

| Risk Factors | Shell companies, fake corporations, financial crime links | Identity theft, fraud, money laundering |

| Ongoing Monitoring | Tracks business changes, financial activity, and ownership updates | Monitors individual transactions and behavior |

How Smart Tools AI Helps with KYB

AI-powered tools simplify and enhance the KYB process by automating verification steps and improving fraud detection. Here are some essential tools we provide that assist in business verification:

- Blacklist Checker: This tool ensures that a business domain isn't flagged for fraud, scams, or illegal activities.

- Fake Address Generator: Useful for testing KYB verification systems by generating sample addresses for compliance checks.

- Phone Number Generator: This tool helps test automated KYB verification processes that require phone validation.

By leveraging our tools, businesses can enhance compliance, reduce manual verification efforts, and mitigate risks associated with fraudulent entities.

Wrapping Up

KYB is a crucial regulatory compliance process that helps businesses safeguard themselves from high-risk businesses and fraudulent partnerships. Following complete screening before onboarding, companies can ensure compliance and develop a solid business relationship. Different regulations govern the KYB system, whereas AI-based tools play a critical role in streamlining the process.

FAQs

Q1: What are the popular KYB requirements?

KYB requirements primarily include verification of business registration details, ownership structure, financial records, and AML compliance.

Q2: What is a KYB checklist?

It typically includes document verification, UBO identification, risk assessment, sanctions screening, and ongoing monitoring.

Q3: How long does the KYB process take?

It can take a few hours to several days based on the verification complexity and efficiency of the tools used.

Explore Related posts

https://smarttoolsai.com/post/credit-card-fraud-and-how-can-businesses-prevent-it

https://smarttoolsai.com/post/liveness-detection-secure-customer-onboarding-and-business-operations

.webp)